Bitcoin is showing early signs of stabilization after a notable shift in positioning among institutional futures traders. Recent data from the Commitment of Traders report indicates that non-commercial participants on the Chicago Mercantile Exchange have sharply reduced their net short exposure over the past month, moving from a modest net long stance to a net short position near 1,600 contracts. Historically, similar unwinds in bearish positioning have coincided with major market bottoms.

CME Bitcoin Futures Positioning Signals Potential Rebound

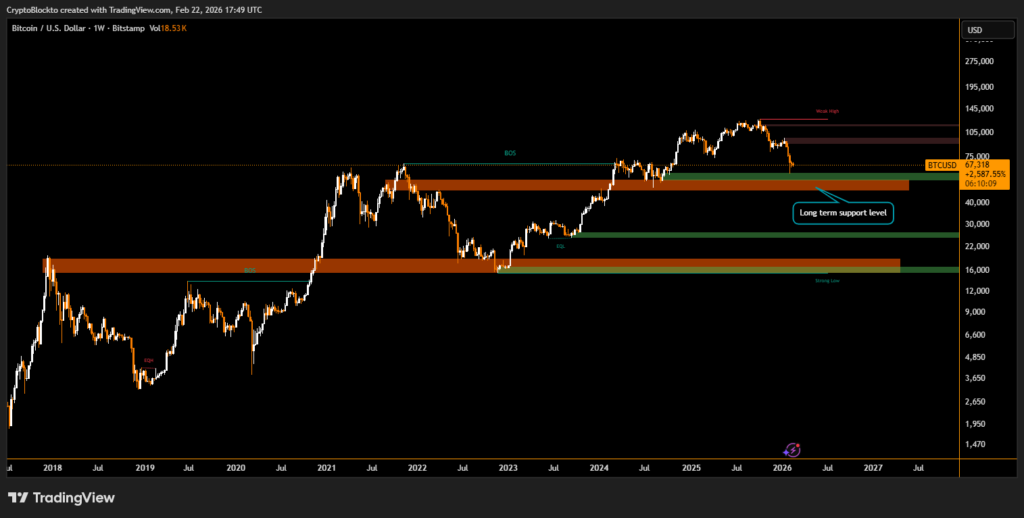

Large speculators, often considered “smart money,” have previously shifted direction ahead of substantial rallies. In 2023, a comparable futures reset preceded a surge of more than 190% in Bitcoin’s price. A similar move in 2025 was followed by a 70% advance. The latest positioning change is unfolding as Bitcoin trades near its 200-week exponential moving average, currently hovering around the $68,000 region — a level that has served as a long-term bear market floor in past cycles.

Technical Indicators Support $85,000 Target

Momentum indicators add weight to the recovery case. The weekly Relative Strength Index remains in oversold territory, suggesting selling pressure may be nearing exhaustion. If Bitcoin decisively rebounds from its 200 week EMA, the next key resistance stands near the 100 week EMA, positioned around $85,000.

Despite improving sentiment, risks persist. In previous downturns, Bitcoin briefly broke below the 200 week EMA before forming a durable bottom. A repeat of that pattern could open the door to a deeper retracement toward the $40kto $50krange before a sustained uptrend resumes.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.