The cryptocurrency market experienced a dramatic surge over the weekend, triggering over $670 million in short liquidations—the largest single liquidation event of 2025 so far. The explosive movement, fueled primarily by altcoin volatility, caught many bearish traders off guard and reinforced the unpredictable nature of the digital asset space.

What Triggered the Liquidation Frenzy?

The liquidation wave was largely driven by a sharp rally across several leading altcoins, including Solana (SOL), Cardano (ADA), and Avalanche (AVAX), many of which saw double-digit gains in less than 48 hours. Bitcoin and Ethereum also contributed to the rally but displayed comparatively moderate upward momentum.

Market analysts suggest a combination of short squeeze dynamics, renewed investor sentiment, and favorable regulatory news (such as the OCC’s recent announcement allowing national banks to offer crypto services) helped catalyze the upward movement.

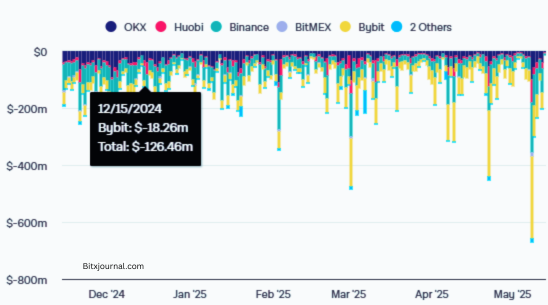

As prices surged, heavily shorted positions began to auto-liquidate across major exchanges like Binance, OKX, and Bybit. The cascade of liquidations intensified the buying pressure, pushing prices even higher in a textbook short squeeze scenario.

A Breakdown of the Liquidation Data

According to data from Coinglass, more than $670 million worth of shorts were liquidated over the weekend, with Sunday seeing the brunt of the wipeout. Bitcoin short positions accounted for around $190 million, while Ethereum saw over $140 million in short liquidations. However, it was altcoins that carried the weight of the storm, contributing to over 50% of total liquidations.

Solana, which surged by nearly 18%, led the altcoin rally and accounted for $55 million in liquidations alone. Cardano and Avalanche followed closely behind, each seeing $30–40 million in liquidations as prices spiked rapidly.

Altcoin Momentum: Speculation or Start of a Bull Trend?

While the weekend’s volatility was a boon for bullish traders, the sustainability of the move remains in question. Some analysts believe this could mark the beginning of a new altcoin season, driven by renewed institutional interest, lower inflation expectations, and the growing adoption of blockchain infrastructure across traditional finance.

Others urge caution, noting that rapid price pumps followed by massive liquidations are often symptomatic of speculative excess rather than long-term growth. Still, the market’s reaction—particularly from retail investors—suggests that confidence is returning.

Market Impact and Exchange Risk Management

The sudden spike in volatility raised concerns about exchange risk management systems, especially as liquidations intensified and trading volumes spiked. Binance and OKX temporarily experienced order processing delays, although both platforms assured users that systems remained stable and all liquidations were executed according to policy.

Traders using high leverage were particularly affected, with leverage ratios above 20x being the most frequently wiped out. Exchanges have since issued reminders to users about the risks of margin trading, especially during uncertain market conditions.

Looking Ahead: Caution in the Wake of Chaos

As the dust settles, the crypto market remains in a state of heightened alert. With U.S. inflation data and possible new regulatory developments expected later this week, traders are watching closely for any signs of trend continuation or reversal.

For now, the weekend’s events serve as a stark reminder of crypto’s high-risk, high-reward nature—and how quickly sentiment can flip in a market driven by leverage and momentum.