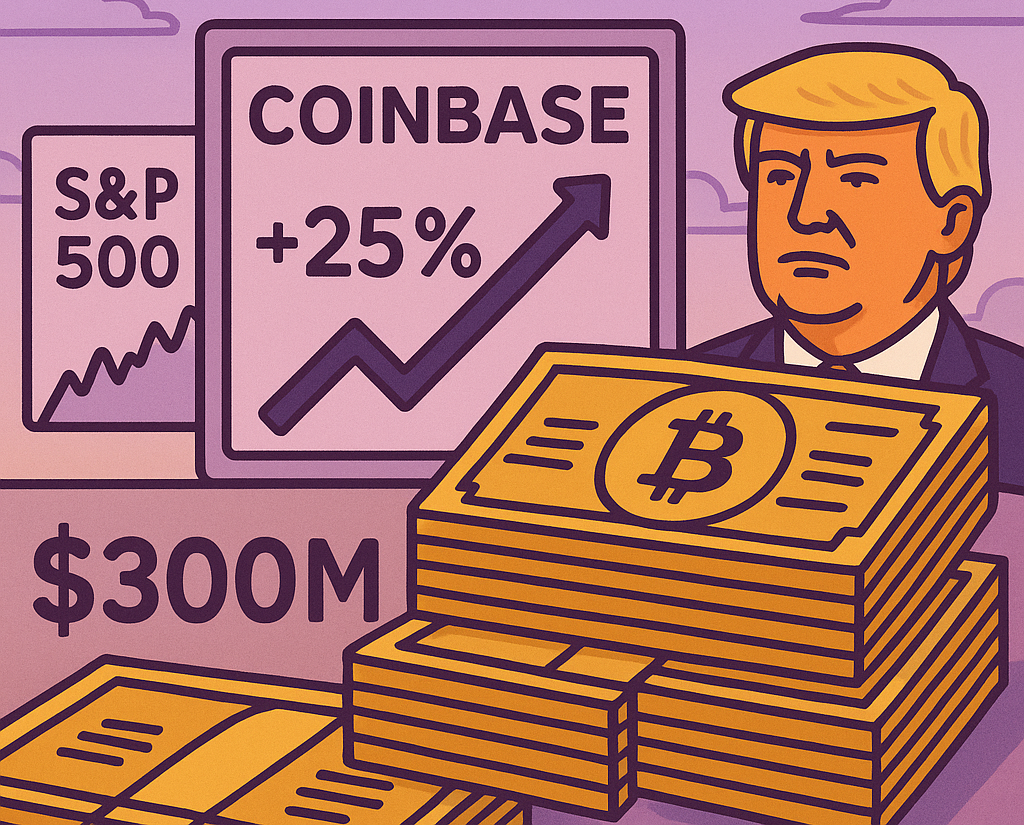

In a major milestone for the crypto industry, Coinbase Global Inc. (COIN) is reportedly set to be included in the S&P 500 index, marking a significant step forward in mainstream acceptance of cryptocurrency-related stocks. The news sent Coinbase shares soaring by over 25%, with analysts forecasting that the move could generate $8–$9 billion in passive inflows from index-tracking funds

Coinbase’s inclusion in one of the most important equity benchmarks means that pension funds, mutual funds, and ETFs that mirror the S&P 500 will be required to purchase COIN shares. This influx of capital is expected to significantly strengthen Coinbase’s market position, further validating crypto as a legitimate part of the financial ecosystem.

What This Means for Crypto Markets

The announcement comes amid renewed interest in digital assets and suggests a broader acceptance of cryptocurrency firms in traditional finance. Coinbase, the largest publicly traded crypto exchange in the U.S., has weathered regulatory scrutiny and market volatility to become one of the most resilient players in the space.

Market analysts believe that Coinbase’s stock could continue climbing as institutional investors adjust their portfolios to accommodate the company. Additionally, the inflows from index funds may have a spillover effect on the broader crypto market by driving investor optimism.

GD Culture Group Announces Bold Crypto Strategy

Meanwhile, GD Culture Group Limited (GDC), a media and tech firm listed on the Nasdaq, made headlines by revealing plans to invest $300 million into Bitcoin and the Trump (TRUMP) memecoin. The company’s pivot toward a crypto-centric strategy represents a growing trend among publicly traded firms seeking exposure to digital assets.

The firm also plans to rebrand itself into a digital asset platform. According to their announcement, this platform will include crypto payment integration, NFT support, and token issuance. The $300 million investment, if executed, would make GD Culture one of the larger corporate holders of both Bitcoin and speculative meme tokens.

Why Bitcoin and Trump Token?

GDC’s planned allocation is drawing attention not just for its size but also for its unconventional mix. While Bitcoin is a time-tested, institutional-grade asset, the TRUMP memecoin is a relatively new entrant driven by hype, political sentiment, and speculative interest.

GDC’s leadership believes that Bitcoin offers long-term store-of-value benefits, while the TRUMP token represents a high-risk, high-reward play aimed at capitalizing on the upcoming U.S. elections. This dual strategy of stability plus speculation is both bold and controversial—and may attract both investors and critics alike.

Broader Market Reactions

The crypto market responded positively to both the Coinbase and GDC announcements. Bitcoin briefly crossed $67,000, and Ethereum reclaimed the $3,100 level. Memecoins also saw a bounce, with the TRUMP token gaining double-digit percentage points after GDC’s announcement.

These moves come at a time when institutional adoption of crypto appears to be accelerating. Traditional financial firms, hedge funds, and tech companies are increasingly integrating digital assets into their balance sheets and service offerings.

Other Notable Developments

- BlackRock’s Ethereum ETF is nearing SEC approval, potentially opening the door for further institutional inflows into ETH.

- Fidelity Digital Assets reported a 24% increase in corporate crypto holdings in Q1 2025.

- MicroStrategy purchased another 2,000 BTC, reaffirming its Bitcoin-first treasury policy.

Conclusion

The inclusion of Coinbase in the S&P 500, coupled with GD Culture’s bold $300 million crypto investment plan, highlights how deeply digital assets are embedding themselves into mainstream financial systems. As legacy finance and emerging digital ecosystems continue to converge, market watchers can expect increasing volatility, innovation, and opportunity in the months ahead.