Matt Hougan, the Chief Investment Officer of Bitwise Asset Management, recently made waves with a nuanced take on crypto investing. While he reaffirms Bitcoin’s role as the market leader, Hougan also advises that diversification is key to long-term success in digital assets — drawing an intriguing comparison to the early 2000s internet boom.

“Bitcoin is King” — The Core of the Crypto Market

In a recent commentary, Hougan stated that “Bitcoin is king,” pointing to its unmatched size, liquidity, and institutional adoption. As the first and most recognized cryptocurrency, Bitcoin continues to be the primary entry point for both individual and institutional investors. It represents a solid, time-tested store of value in the digital economy.

Hougan compared Bitcoin to Amazon during the dot-com era — a leading force that withstood market volatility and emerged stronger over time. Today, Bitcoin holds a similar position in the crypto world, with a market cap well above any other digital asset.

Learning from the Past: The 2004 Tech Investment Analogy

Hougan drew a parallel between the current state of crypto investing and internet stocks in 2004. Back then, Amazon was the standout success story, but other now-giant firms like Google, Salesforce, and Meta were just beginning to rise.

“If you only bought Amazon in 2004, you did well. But if you held a basket that included other emerging tech stocks, you did even better,” Hougan explained. He sees the same opportunity in crypto today, with projects like Ethereum, Solana, and other layer-1 and layer-2 solutions showing rapid innovation and potential.

Why a Crypto Portfolio Shouldn’t Be Bitcoin-Only

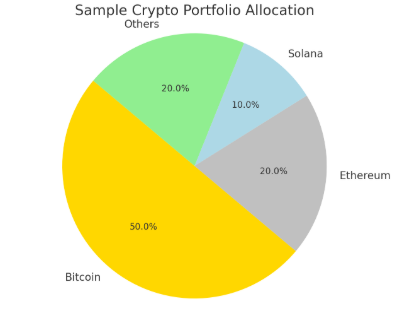

Despite Bitcoin’s leadership, Hougan suggests that focusing solely on BTC could mean missing out on the next wave of explosive growth in the space. While Bitcoin offers relative stability and predictability, newer coins and platforms are solving real-world problems — from decentralized finance (DeFi) to smart contracts, cross-chain interoperability, and tokenized assets.

A diversified crypto portfolio, according to Hougan, balances the strength of Bitcoin with the upside of fast-developing blockchain ecosystems. This strategy provides exposure to both short-term trends and long-term technological disruption.

Institutions Are Warming Up to Broader Crypto Exposure

Institutional investors are already taking note. While Bitcoin ETFs brought crypto into mainstream finance, asset managers are now looking to expand their offerings to include Ethereum and other altcoins. Hougan’s firm, Bitwise, is one of several pushing for multi-asset crypto investment products that offer exposure to the broader blockchain market.

This trend mirrors the broader movement from “just Bitcoin” to “crypto as a sector” — with each digital asset representing a different innovation vertical.

Conclusion: Bet on Bitcoin, But Don’t Stop There

While Bitcoin remains the cornerstone of any crypto investment strategy, Matt Hougan urges investors to think ahead. Just like tech investors in the early 2000s who looked beyond Amazon, today’s crypto investors might benefit from casting a wider net. A balanced crypto basket could be the key to maximizing future gains while still relying on Bitcoin’s proven stability.