Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has once again reclaimed a 10% share of the overall crypto market. This milestone, while symbolically significant, comes amidst a mixed landscape of investor sentiment, on-chain data, and macroeconomic uncertainty. While Ethereum’s market share recovery suggests renewed interest, experts warn that a full-scale rally may not be on the immediate horizon.

The Significance of Ethereum’s 10% Market Share

Reaching a 10% share in the total crypto market cap marks a psychological threshold for Ethereum supporters. It suggests that despite increased competition from rival Layer-1 platforms such as Solana, Avalanche, and BNB Chain, Ethereum still holds a dominant position in decentralized finance (DeFi), NFTs, and smart contract deployment.

This resurgence has been partly fueled by Ethereum’s successful transition to Proof-of-Stake (PoS) through the Merge, which significantly reduced its energy consumption and aligned it more closely with ESG investment goals. Additionally, Layer-2 scaling solutions like Arbitrum and Optimism have contributed to user retention by reducing gas fees and increasing transaction throughput.

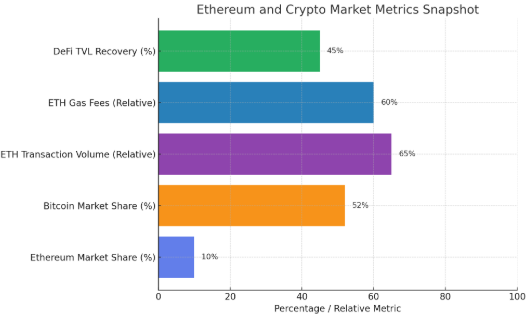

Ethereum’s 10% market share

Bitcoin’s 52% market share

Relative ETH transaction volume and gas fees

DeFi total value locked (TVL) recovery at 45%

Why Bulls Should Remain Cautious

However, market analysts caution that this recovery may not be as bullish as it appears. Ethereum’s market share increase doesn’t necessarily equate to price momentum. In fact, ETH has shown relative underperformance compared to Bitcoin (BTC) in recent weeks. BTC dominance has remained high, supported by institutional interest and macroeconomic factors such as ETF approvals and its role as digital gold.

Moreover, Ethereum’s daily transaction volumes and gas fees—key indicators of network activity—have not seen a proportional spike. This suggests that while investor confidence in ETH may be stabilizing, actual usage growth is still modest. DeFi total value locked (TVL), another important metric, remains significantly below its 2021 highs, reflecting a cautious stance by users and liquidity providers.

Market Headwinds: Macroeconomics and Competition

Another challenge is the broader economic backdrop. Rising interest rates and uncertain inflation data have impacted risk assets across the board, including cryptocurrencies. The U.S. Federal Reserve’s monetary policy continues to cast a long shadow over market recovery, making any sustained uptrend for Ethereum more difficult.

At the same time, competing chains are making significant technological and community gains. Solana, for instance, has seen surging activity in NFT marketplaces and meme coin trading, offering faster speeds and lower fees. This has diverted some developer and investor attention away from Ethereum, despite its more established infrastructure.

The Path Ahead: Consolidation or Breakout?

In the short term, Ethereum’s price appears range-bound, and market analysts suggest that a breakout above key resistance levels (e.g., $3,500) is necessary to confirm a bullish trend. On-chain metrics like whale accumulation and exchange outflows will also need to show strength to support a sustainable rally.

That said, the long-term fundamentals of Ethereum remain strong. It continues to be the most adopted blockchain for decentralized applications, with a robust developer ecosystem and active roadmap, including the upcoming Dencun upgrade to improve data availability.

Conclusion

Ethereum’s return to a 10% market share is a promising sign—but not a reason for unbridled bullishness. With mixed signals from market data, ongoing macroeconomic pressures, and stiff competition from emerging platforms, ETH bulls would be wise to temper their expectations. The road to a new all-time high is still under construction.