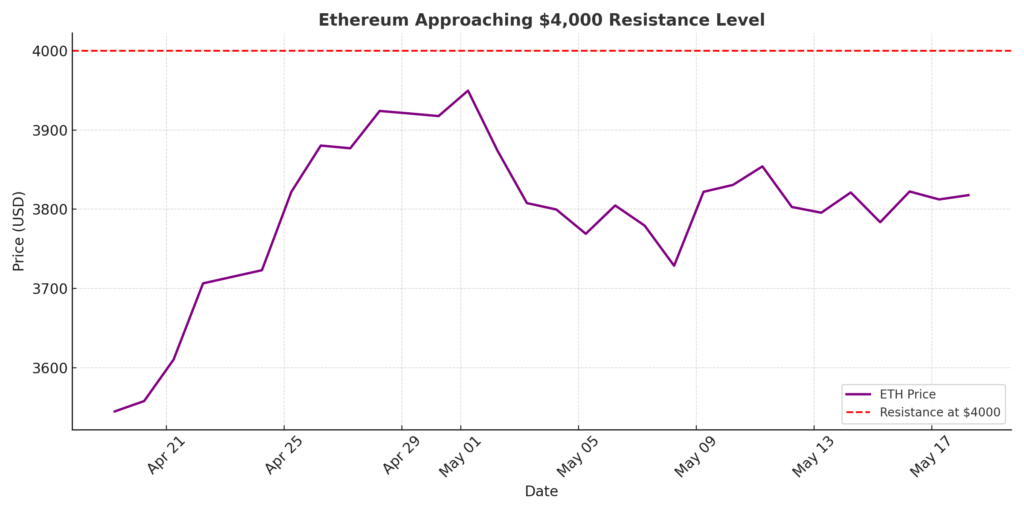

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is drawing closer to a major resistance level at $4,000. This price point has historically served as a strong barrier, and a breakout or rejection here could shape Ethereum’s near-term future.

Ethereum Builds Bullish Momentum

Over the past few weeks, Ethereum has gained strong upward momentum, riding on the coattails of bullish market sentiment and broader crypto resurgence. At the time of writing, ETH is trading just below $4,000, having rallied from support levels near $3,500.

Key drivers behind this momentum include:

- Rising institutional interest in Ethereum

- Growing decentralized finance (DeFi) activity

- Speculation around Ethereum ETF approvals

- Network upgrades improving scalability and fees

This growing confidence among both retail and institutional investors is pushing Ethereum toward a crucial technical breakout zone.

Why the $4,000 Mark Is So Significant

The $4,000 level is not just psychological—it’s also a historically strong resistance point. Ethereum has failed to break past this price several times in the past, resulting in notable pullbacks.

If ETH successfully breaks above $4,000 and holds, analysts believe the next resistance zones lie at $4,500 and $5,000, potentially triggering a new bullish leg. On the other hand, a failure to sustain the rally could push ETH back to key support levels near $3,700 or $3,500.

Catalysts That Could Trigger a Breakout

There are several bullish catalysts that may determine whether Ethereum can finally overcome this hurdle:

- Anticipation of a spot Ethereum ETF in the U.S., which could attract institutional capital

- Ethereum network upgrades, reducing gas fees and improving transaction speed

- Broader crypto market sentiment, particularly Bitcoin’s trajectory

- DeFi and NFT market growth, which relies heavily on Ethereum’s infrastructure

Analysts also point to increasing on-chain activity and rising ETH staking participation as signs of a maturing and strengthening ecosystem.

Conclusion

Ethereum is facing a pivotal moment as it approaches the $4,000 level. A decisive breakout could ignite a powerful rally, while a rejection may signal short-term consolidation or correction.

Traders and investors should closely watch price action around this level, as it may set the tone for Ethereum’s trajectory in the second half of 2025.

With growing interest, institutional support, and technological innovation, Ethereum remains one of the most important and influential assets in the digital economy. The coming days could prove decisive for ETH’s next big move.