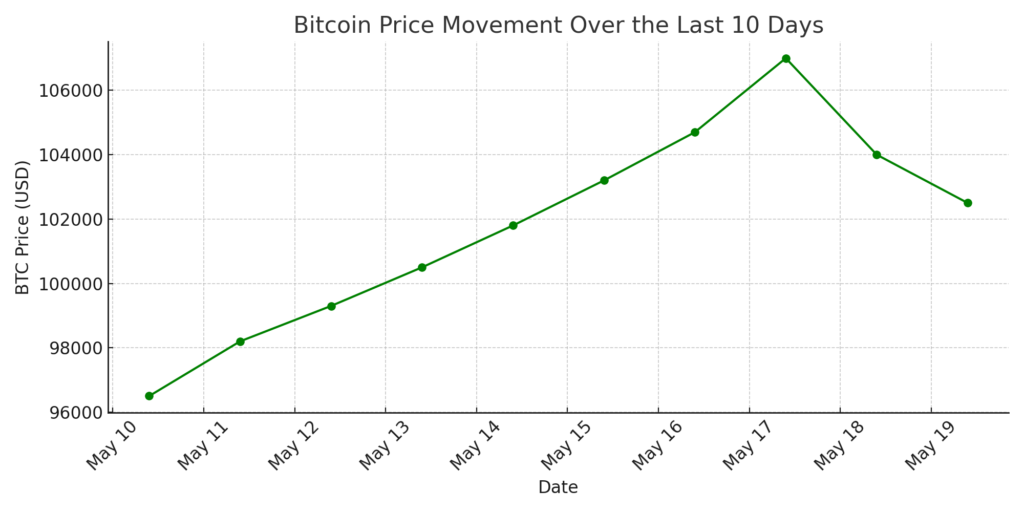

Bitcoin (BTC) has once again captured headlines after briefly surging to $107,000, a move that left traders wondering: was it a fakeout, or is a new all-time high around the corner? As the market digests this volatile price action, here are 4 key things to watch this week that could decide Bitcoin’s next move.

1. $107K Wick: Real Breakout or Bull Trap?

Bitcoin’s surge above $107K triggered excitement across crypto Twitter and institutional circles. However, the price quickly retreated below $104,000, leaving many questioning if it was a liquidity grab rather than a genuine breakout.

“This has all the signs of a classic fakeout,” said analyst Josh Rager. “But it also shows how much demand is sitting just above resistance.”

If BTC manages to hold above the $100K psychological level this week, it could build a strong base for the next leg up.

2. ETF Inflows and Institutional Momentum

Spot Bitcoin ETFs continue to see strong inflows, indicating ongoing institutional demand. According to recent data, BlackRock’s iShares Bitcoin Trust added hundreds of millions in BTC last week alone.

This institutional tailwind has been a major driver behind Bitcoin’s 2025 rally. If the inflows continue, it could fuel a sustainable move beyond the $107K zone.

“ETF flows are the new on-chain metric,” notes crypto analyst James Butterfill.

3. Macro Events: Fed Minutes & CPI Impact

This week, traders are closely watching macroeconomic data releases, especially the Federal Reserve minutes and any updates on CPI inflation data.

A dovish tone from the Fed or signs of slowing inflation could boost risk assets, including Bitcoin. Conversely, any hawkish signals might pressure BTC and the broader crypto market.

4. Technical Levels to Watch

- Immediate resistance: $107,000 – the recent local high

- Support levels: $100,000 (psychological), $96,500 (recent consolidation zone)

Traders are also watching the weekly close, which will determine if the breakout has legs. A close above $105,000 could confirm bullish continuation.

Final Thoughts

This week could be pivotal for Bitcoin. Whether the $107K move was a bull trap or the start of a new price discovery phase, all eyes are on volume, ETF flows, and macro signals.

Stay alert. Bitcoin is at a technical and psychological crossroads.