Stablecoin Giant Now Among Top Global Buyers of U.S. Debt

Tether (USDT), the world’s largest stablecoin issuer, has made headlines once again — this time by surpassing Germany in its holdings of U.S. Treasury bills, reaching over $111 billion. This remarkable milestone positions Tether as one of the largest holders of U.S. government debt, a status traditionally dominated by major economies and central banks.

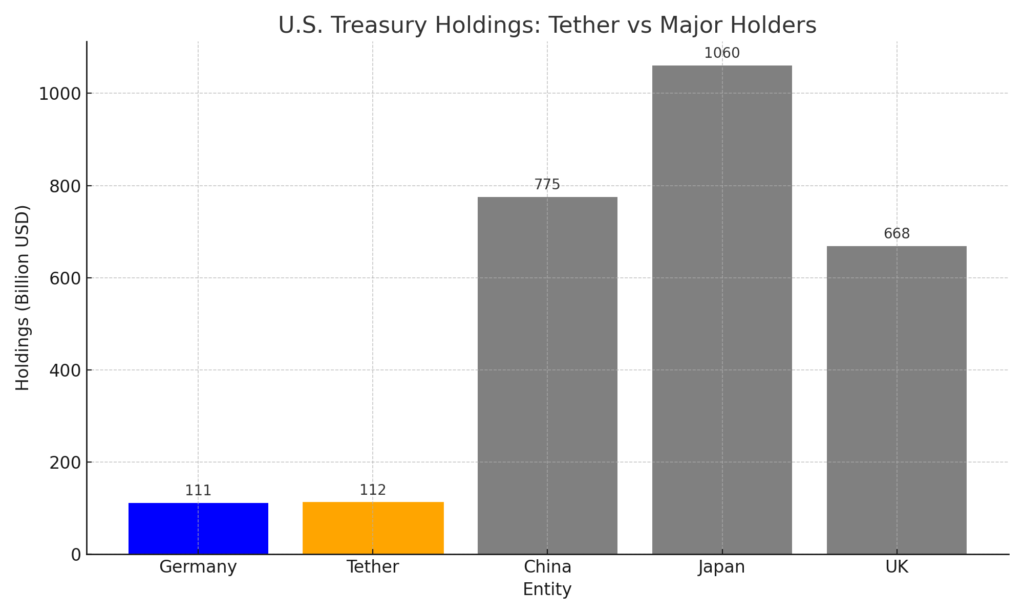

chart comparing Tether’s U.S. Treasury holdings to major global holders:

Tether’s Strategy: Stability Through Treasuries

According to Tether’s latest attestation report, the company holds more than $90 billion in U.S. Treasury bills, alongside additional exposure through repo agreements and money market funds. These holdings are part of the company’s commitment to backing USDT with high-quality, liquid assets, providing trust and transparency to its users worldwide.

“We’re proud to play a role in global financial markets while increasing USDT’s backing with the most secure assets,” said Paolo Ardoino, CEO of Tether.

Why This Matters: Stablecoins as Financial Players

This shift signals a major evolution in the crypto space. Tether is no longer just a crypto utility token — it’s a major participant in traditional finance. By owning more U.S. debt than Germany, Tether underscores the increasing interdependence between the crypto industry and legacy financial systems.

While countries like China and Japan still lead with massive holdings of U.S. Treasuries, Tether’s rise reflects a growing demand for U.S. dollar-pegged assets outside traditional banking systems — especially in emerging markets where access to dollars is restricted or inflation is high.

Critics Raise Concerns Over Transparency

Despite its success, Tether has faced long-standing questions about the transparency and auditability of its reserves. Although it regularly releases attestation reports, critics and regulators have called for full audits to ensure every USDT is properly backed.

Still, the company’s expanding Treasury portfolio has helped silence many skeptics, especially as traditional financial institutions begin to integrate stablecoins into payment rails and settlement systems.