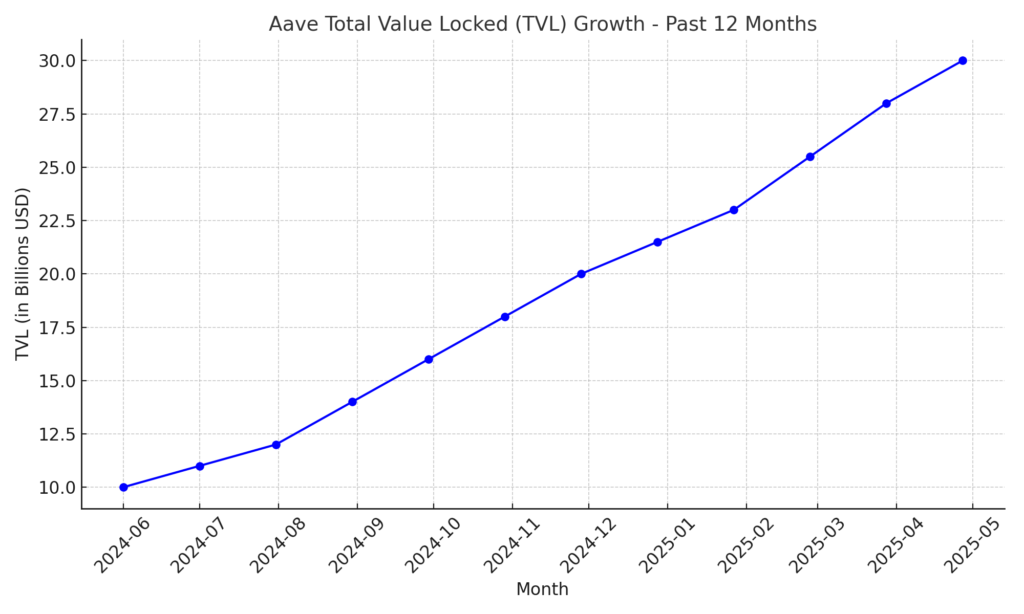

In a major milestone for the decentralized finance (DeFi) ecosystem, Aave’s Total Value Locked (TVL) has surpassed $30 billion, reflecting a powerful resurgence of activity and investor confidence in the Ethereum-based protocol.

Aave, one of the leading DeFi lending platforms, allows users to lend and borrow cryptocurrencies without intermediaries. The recent surge in TVL is widely seen as a sign of renewed strength in Ethereum DeFi, following months of market consolidation and regulatory uncertainty.

Bullish Indicators for Ethereum and DeFi

The $30 billion TVL mark is the highest Aave has seen since late 2021, during the peak of the last crypto bull run. Analysts point to rising Ethereum prices, increased institutional interest, and layer-2 adoption as key drivers behind the surge.

“Aave’s growth is not just impressive, it’s foundational. It reflects the strength of DeFi infrastructure built on Ethereum,” said a DeFi analyst from Dune Analytics.

With the launch of Aave V3 and support for Ethereum Layer-2 networks like Optimism and Arbitrum, the platform has attracted new liquidity, reduced gas costs, and expanded its ecosystem across multiple chains.

What’s Behind the TVL Surge?

Several factors are contributing to Aave’s latest growth spurt:

- Increased borrowing and lending activity as ETH prices approach new highs.

- Enhanced security and flexibility with Aave V3 updates.

- Renewed DeFi interest as TradFi remains under regulatory pressure.

- Greater stablecoin usage like USDC and USDT on Aave’s protocol.

“The $30B milestone solidifies Aave as a top-tier DeFi protocol in the Ethereum ecosystem,” one market watcher noted.

This trend also underscores Ethereum’s position as the dominant smart contract platform, with Aave acting as a key player in driving user engagement and liquidity.

The Bigger Picture for DeFi

Aave’s TVL growth is not occurring in isolation. It comes amid a broader resurgence in Ethereum-based DeFi protocols, including MakerDAO, Compound, and Lido. This surge is contributing to a broader DeFi revival, just as the crypto market eyes potential bullish catalysts such as Ethereum ETF approvals and macroeconomic easing.