In a dramatic escalation of one of crypto’s most high-profile bankruptcies, Genesis Global Capital has filed two major lawsuits against its parent company, Digital Currency Group (DCG), and its CEO, Barry Silbert, seeking to claw back more than $3.3 billion in what the firm claims were fraudulent and self-serving transfers.

Dual Lawsuits Target Transfers and Misconduct

Genesis filed the lawsuits in Delaware Chancery Court and the U.S. Bankruptcy Court for the Southern District of New York, accusing DCG and Silbert of siphoning over $1.2 billion from Genesis during the year leading up to its bankruptcy in January 2023.

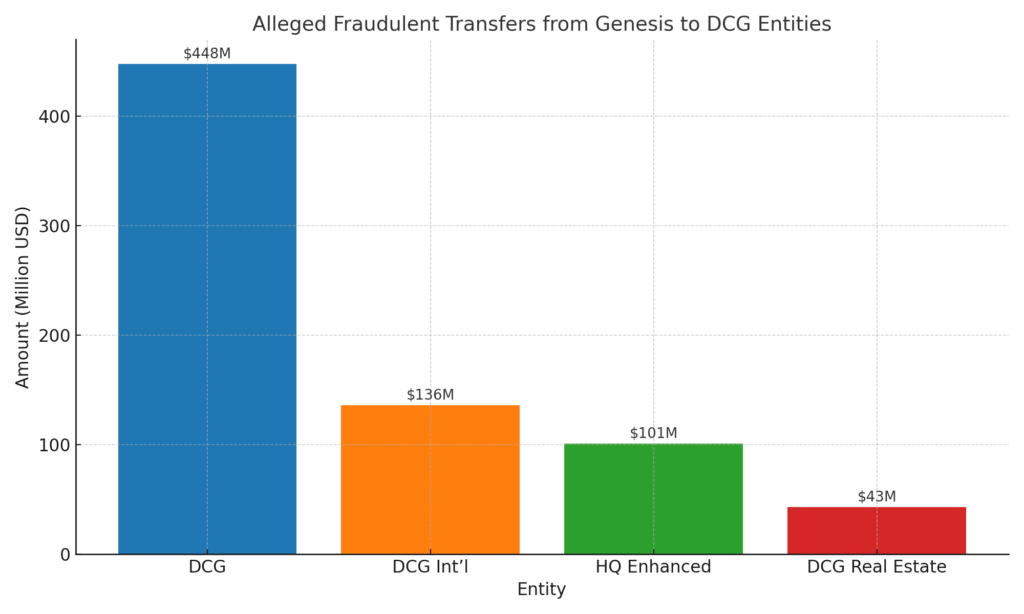

The filings allege that DCG used Genesis “as a personal ATM” for its other subsidiaries, including Grayscale Investments, DCG International, and HQ Enhanced Yield Fund, all while misrepresenting financial support and inflating the company’s solvency.

Among the withdrawals cited in the complaints:

Reckless Lending, Fake Deals, and No Oversight

Genesis, once a key player in crypto lending, claims it operated without a formal board of directors or internal compliance, giving Silbert and other executives unchecked power. The lawsuits argue that leadership ignored “elementary risk management practices” and created sham transactions at the end of Q2 and Q3 2022 to make it appear that DCG was backstopping Genesis’s loans—when, in fact, it wasn’t.

These fake deals misled Genesis creditors and crypto partners, including institutional investors, into believing the company was stable while it was rapidly collapsing under the weight of liquidity shortages and overleveraged exposure.

Creditors Still Owed Billions

As of February 2025, Genesis’s creditors are still owed roughly:

- 19,086 BTC

- 69,197 ETH

- 17.1 million additional crypto tokens

- Plus accrued fees, interest, and penalties totaling over $2.2 billion

The firm argues that without intervention, those assets may never be fully recovered due to alleged fraudulent transfers and insider enrichment schemes.

DCG Responds: “Baseless and Misleading”

In response, DCG issued a statement calling the lawsuits “baseless” and said the company made good-faith efforts to stabilize Genesis and cooperate with stakeholders. It strongly denied any wrongdoing by Barry Silbert or its executives and described Genesis’s portrayal as a “gross misrepresentation” of events.

The lawsuits come at a time when DCG itself is under scrutiny from regulators and other creditors involved in the crypto contagion that followed the collapse of FTX, Three Arrows Capital, and other major players.

Conclusion

The lawsuits filed by Genesis represent a major turning point in efforts to hold crypto executives accountable for the chaotic and under-regulated boom years of 2021–2022. As litigation unfolds, the broader crypto industry is watching closely. These cases could set key legal precedents around corporate governance, creditor protections, and the responsibilities of parent companies during market crises.