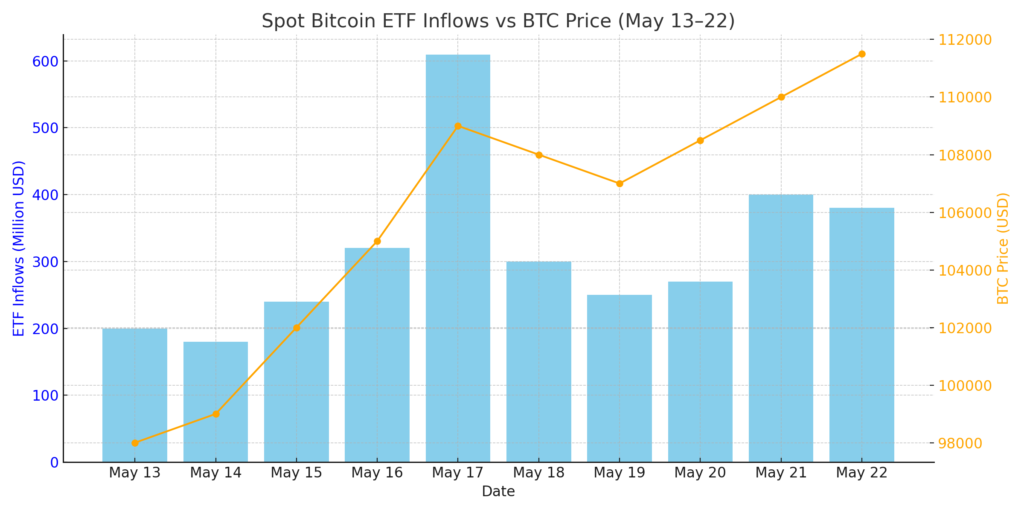

Spot Bitcoin exchange-traded funds (ETFs) attracted $609 million in net inflows in a single day, as Bitcoin surged past its previous all-time high, signaling renewed enthusiasm from institutional and retail investors alike. The strong inflow marks one of the most bullish signals yet for mainstream adoption of cryptocurrency investment products.

“The numbers speak for themselves — investors want Bitcoin exposure in a regulated wrapper,” said an ETF strategist at Bloomberg.

BTC Breaks Records, Ignites ETF Momentum

Bitcoin (BTC) soared to a new record high, surpassing $109,000, amid easing macroeconomic tensions and growing global demand for decentralized assets. This breakout has been a catalyst for massive inflows into spot BTC ETFs, particularly in the U.S. market.

Leading ETFs such as BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) were among the top performers, attracting hundreds of millions in investor capital.

“Institutional confidence is growing, and ETF inflows are the clearest proof of that,” noted James Butterfill, head of research at CoinShares.

Data Highlights

According to market tracking firm Farside Investors:

- $609 million in net inflows were recorded on the day Bitcoin broke its ATH.

- BlackRock’s IBIT led the charge with over $350 million in a single day.

- Total cumulative inflows into all U.S. spot Bitcoin ETFs have now exceeded $14 billion since launch.

Why the Inflows Matter

Spot Bitcoin ETFs allow investors to gain direct exposure to Bitcoin’s price without needing to hold or manage the asset themselves. The recent surge in inflows indicates growing trust in regulated crypto products and a desire to participate in Bitcoin’s upside without the risk of self-custody.

“This level of institutional flow has never been seen in crypto history,” said a senior analyst at Galaxy Digital. “It confirms that Bitcoin is no longer a fringe asset — it’s part of the mainstream financial landscape.”

ETF Surge Fuels Bullish Sentiment

Market analysts believe these ETF inflows could be the beginning of a new bull market cycle for Bitcoin, potentially driving prices even higher in the coming weeks. The broader crypto market has also seen gains, with Ethereum and Solana following BTC’s upward momentum.

Conclusion

The $609 million ETF inflow marks a milestone in Bitcoin’s integration into traditional finance. As more investors seek regulated, efficient ways to gain exposure to crypto, spot ETFs are poised to play a central role in future market dynamics.

With Bitcoin rewriting history, the eyes of Wall Street and Main Street are firmly fixed on what comes next.