Bitcoin’s Role in Corporate Treasury is Just Beginning

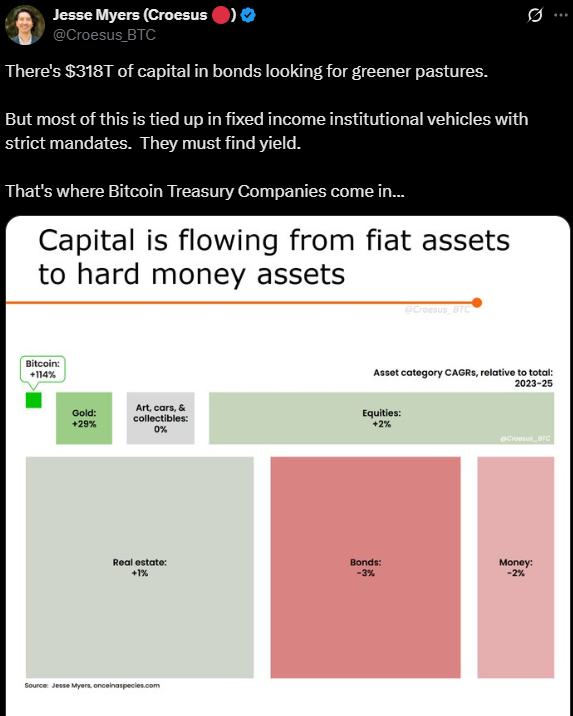

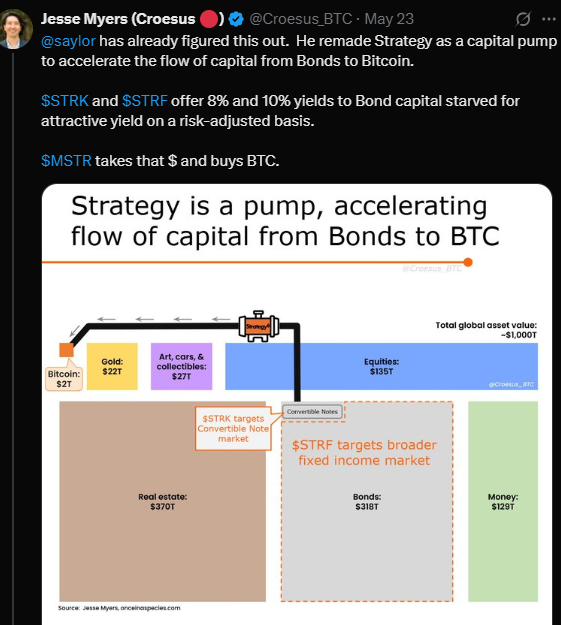

A growing number of corporate executives are turning to Bitcoin as a long-term store of value, and some believe this shift is only accelerating. According to a recent statement from a leading Bitcoin executive, the exodus from fiat assets has already begun, and Bitcoiners are underestimating how much Bitcoin treasury companies will ultimately hold.

“Corporate Bitcoin adoption is not just a trend — it’s a structural shift away from fiat dependency,” says jesse Myers, a prominent Bitcoin strategist.

Forecasting the Future: $70 Trillion in Bitcoin Treasuries by 2025?

In a bold projection, Myers claims that companies globally could hold over $70 trillion in Bitcoin by 2025. This would represent an astronomical increase from today’s levels, where corporate Bitcoin holdings are estimated in the tens of billions.

“Bitcoin will become a standard reserve asset on every corporate balance sheet — just like cash or gold,” Myers added.

This prediction is fueled by increasing macroeconomic instability, dollar debasement, and the rising acceptance of crypto by traditional financial institutions.

Bitcoin Treasury Trend: From MicroStrategy to Nation-States

The shift began with companies like MicroStrategy, Tesla, and Square, which pioneered the movement of placing Bitcoin in their corporate treasuries. Today, over 50 publicly listed companies hold Bitcoin as a strategic asset.

MicroStrategy alone holds more than 214,000 BTC, valued at over $23 billion.

This trend has also influenced sovereign adoption, with countries such as El Salvador and the Central African Republic now holding Bitcoin as part of national reserves.

Why Companies Are Flocking to Bitcoin

There are several compelling reasons for this migration:

- Protection against inflation and currency devaluation

- Increased liquidity and 24/7 tradability

- Growing investor and shareholder demand for alternative assets

“Holding Bitcoin isn’t risky anymore — it’s risky not to,” Myers emphasized.

As Bitcoin’s market cap remains above $2.2 trillion, more institutions view it as a legitimate, reliable long-term asset.

Conclusion: Bitcoin Treasuries to Redefine Corporate Finance

If Myers’ forecast proves correct, the corporate accumulation of Bitcoin could outpace even the most bullish expectations. With $70 trillion in potential demand, the Bitcoin market could be on the verge of its largest institutional wave yet.

The age of fiat-heavy balance sheets may be ending — and Bitcoin could be the next global reserve norm.