Ethereum (ETH) made headlines this week after breaking above the $2,700 resistance level, fueled by a short squeeze and renewed optimism in the altcoin market. However, beneath this bullish breakout, key on-chain metrics reveal signs of weakening momentum, prompting analysts to question the sustainability of the rally.

This zone, highlighted as a liquidity cluster on the Liquidation Delta chart,

Short Squeeze Propels ETH Beyond $2,700

On May 24, Ethereum’s price spiked to $2,725, triggering the liquidation of over $30 million in ETH short positions within 24 hours. The surge was seen as a technical breakout, pushing ETH to its highest level in three weeks.

“Ethereum’s breakout was not organic; it was driven by derivative market imbalances,” said crypto analyst Ali Martinez.

The short squeeze created a sharp price spike, but not necessarily a sustainable trend.

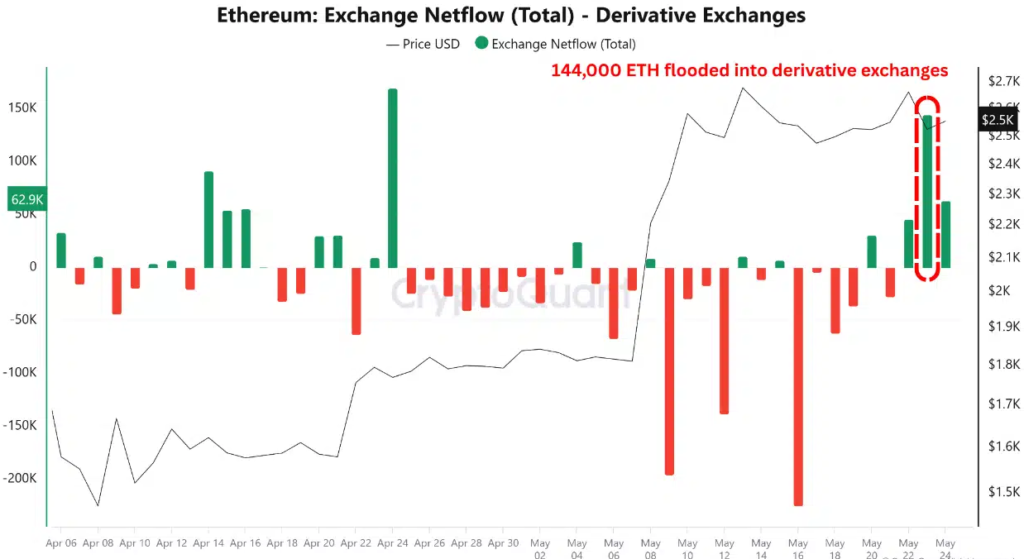

Rising Exchange Reserves Raise Red Flags

Despite the breakout, exchange reserves for ETH have risen by nearly 4% in the past week, according to data from CryptoQuant. This signals that more ETH is being moved to centralized exchanges, often an indicator of imminent selling pressure.

“When whales move ETH to exchanges, it often precedes a local top,” warned market tracker Lookonchain.

Ethereum Decoupling From Bitcoin: Not Always a Good Thing

Interestingly, Ethereum has started to decouple from Bitcoin, gaining 4.2% this week compared to BTC’s 1.3% dip. While on the surface this may seem bullish for ETH, historically, unsustained decoupling during macro uncertainty often leads to correction.

ETH/BTC trading pairs are showing signs of weakening volume, a common precursor to reversals.

Layer-2 Activity and Retail Participation Cooling Down

A concerning trend is the decline in Layer-2 (L2) activity such as on Arbitrum and Optimism. Daily transactions and active addresses on these networks have dropped by 15–20%, suggesting a decline in network usage and DeFi engagement.

In addition, Google Trends data shows stagnant search interest in Ethereum, reflecting retail investors’ lack of engagement during the current price move.

Retail participation is a key driver of sustainable bull runs, and its absence weakens ETH’s momentum.

Conclusion: Cautious Optimism Advised

Ethereum’s break above $2,700 is technically impressive — but on-chain data paints a mixed picture.

With rising exchange reserves, falling L2 activity, and retail disinterest, ETH’s current rally may struggle to maintain its pace unless broader adoption or fundamental catalysts emerge.