Michael Saylor, Executive Chairman of MicroStrategy, has sparked fresh market buzz after suggesting his firm may buy the Bitcoin dip, following a minor correction in BTC’s price. His comment comes at a time when Bitcoin has retreated slightly from its recent highs, offering what many view as a strategic accumulation opportunity.

“We’re always evaluating the market, and we’re long-term focused,” Saylor said in a recent interview, hinting at potential upcoming purchases.

MicroStrategy’s Bitcoin Bet: Over $21.8 Billion in Unrealized Gains

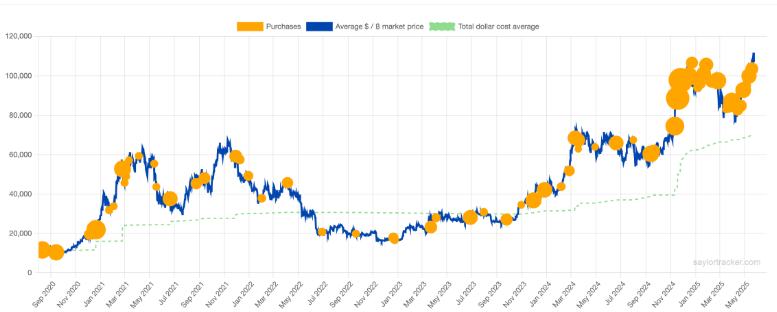

According to SaylorTracker, an independent analytics tool that monitors MicroStrategy’s Bitcoin holdings, the firm is currently sitting on over $21.8 billion in unrealized capital gains. MicroStrategy holds approximately 214,400 BTC, acquired at an average price of $33,700.

That’s a total investment of around $7.2 billion — now valued at more than $29 billion — showing a return of over 54%.

This remarkable growth positions MicroStrategy as the largest corporate holder of Bitcoin, far ahead of Tesla and other institutional investors.

Bitcoin Pullback Creates New Buying Window

Bitcoin recently dipped below $108,000, triggering renewed volatility and shaking out overleveraged positions. But to seasoned investors like Saylor, these dips are not a sign of weakness — but opportunity.

“We view Bitcoin as digital property. Dips just mean it’s on sale,” Saylor has repeatedly emphasized.

The recent correction has also coincided with macro uncertainty, minor profit-taking, and large whales flipping positions — like a recent $1 billion short opened on Hyperliquid.

Institutional Momentum Still Strong

Despite short-term volatility, institutional interest in Bitcoin remains robust, particularly with the launch of U.S. spot Bitcoin ETFs and increasing global adoption.

MicroStrategy’s Bitcoin holdings now represent a strategic asset class for the company, contributing to both balance sheet strength and investor confidence.

Market analysts expect MicroStrategy’s next quarterly filing to potentially include additional Bitcoin purchases, especially if BTC stays under pressure in the near term.

Final Outlook: A Bullish Signal for Long-Term Investors

Michael Saylor’s continued conviction in Bitcoin reinforces the long-term bullish case for the asset. His consistent strategy of “buying the dip” has not only paid off massively for MicroStrategy but has also influenced broader institutional adoption trends.

With over $21.8B in paper profits, Saylor’s strategy shows no signs of slowing down.

Key level to watch: If BTC remains below $110,000, further institutional accumulation could follow.