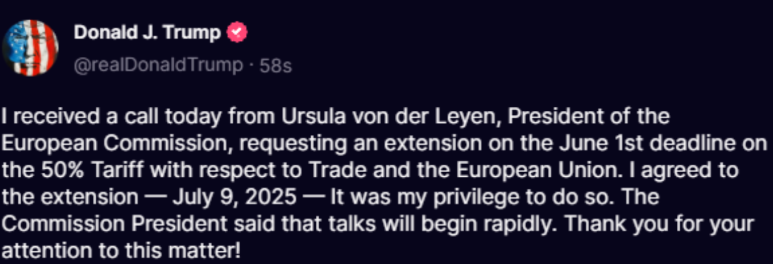

Bitcoin (BTC) surged back above the $109,000 mark following a surprise policy move by U.S. President Donald Trump, who announced the delay of a planned 50% tariff on EU goods until July 9. The decision appears to have temporarily eased global trade tensions, sparking renewed interest in risk-on assets like cryptocurrencies.

Tariff Delay Fuels Bitcoin’s Momentum

On May 25, Bitcoin briefly dropped to a low of $106,660, but quickly rebounded as news broke that the EU tariff deadline had been extended. By May 26, BTC had rallied as much as 3.2%, reaching an intraday high of $110,100, according to Cointelegraph Markets Pro and TradingView.

“This short-term relief in macro pressure is helping risk assets like Bitcoin regain bullish momentum,” said analyst Michaël van de Poppe.

Why Trade Policy Matters for Crypto

The cryptocurrency market has become increasingly sensitive to macroeconomic and geopolitical shifts. As traditional markets react to uncertainty, Bitcoin often functions as an alternative asset class, sometimes even behaving like a safe haven.

“A delay in harsh economic policies gives Bitcoin more room to breathe,” noted economist Alex Krüger.

This latest tariff delay has temporarily reduced the fear of a trade war, allowing crypto bulls to refocus on fundamentals and technical patterns.

Key Bitcoin Price Levels to Watch

With Bitcoin currently trading at $109,824, analysts are identifying several critical resistance and support zones:

- Immediate resistance: $110,500 (intraday high)

- Psychological barrier: $112,000

- Support zones: $108,000 and $106,500 (recent low)

“If BTC breaks and holds above $110,500, we could see a push toward new all-time highs around $120,000,” said trader Rekt Capital.

Conclusion: Bullish Sentiment Returns — But Caution Remains

While Trump’s tariff delay has provided short-term relief and a push in BTC’s price, traders are urged to stay alert. Volatility remains high, and the next few weeks could determine whether Bitcoin breaks out or pulls back.

Keep a close eye on the July 9 deadline — and BTC’s reaction in the days leading up to it.