Japanese investment firm Metaplanet is making headlines as its stock trades at a staggering premium equivalent to nearly $600,000 per Bitcoin, over five times the current BTC spot price, according to a May 27 report from 10x Research.

Stock Trades Like Bitcoin is Worth $596K

With Bitcoin trading around $109,613, Metaplanet’s valuation implies a BTC price of $596,154 — an extreme divergence fueled by speculative investor behavior. The report warns that uninformed retail investors may be dramatically overpaying for exposure to Bitcoin by investing in Metaplanet stock.

“A little-known Japanese stock trades as if Bitcoin were worth $596,154,” 10x Research noted.

This discrepancy stems from a misunderstanding of net asset value (NAV), which represents the true per-share worth of the company’s holdings.

Metaplanet Aims for 21,000 BTC by 2026

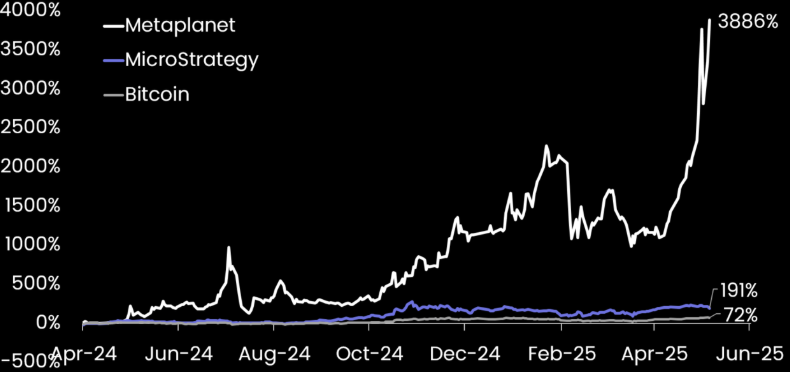

Metaplanet has become Asia’s leading Bitcoin treasury firm, aggressively targeting a 21,000 BTC acquisition by 2026 — positioning itself as Japan’s answer to MicroStrategy. The company has attracted retail investors priced out of direct Bitcoin investment due to its rising cost.

According to Markus Thielen, CEO of 10x Research, retail investors now represent just 7% of the BTC market, peaking in December 2023 before tapering off as BTC crossed $45,000, the cost of an average new car in the U.S.

“Retail investors tuned out once Bitcoin became too expensive to access directly,” said Thielen.

Premiums Reflect Hype and Limited Financial Literacy

Analysts suggest that lack of education and the appeal of indirect exposure are key reasons for inflated premiums. While such stocks offer convenience and perceived safety, they often don’t provide the upside leverage investors expect.

Other Bitcoin treasury firms are seeing similar overvaluations as proxy stocks grow in popularity, even while posing limited financial benefits over direct BTC ownership.

Global Adoption Narrative Still Intact

Despite overvaluation, experts like Blockstream CEO Adam Back remain bullish, viewing firms like Metaplanet as early movers in a possible $200 trillion hyperbitcoinization era.

“These companies are front-running global Bitcoin adoption,” Back noted, highlighting their role in normalizing BTC as a strategic treasury reserve asset.