The crypto industry continues to face mounting security threats, with Cork Protocol becoming the latest victim of a smart contract exploit that drained approximately $12 million in digital assets. The attack occurred on May 28, 2025, and prompted the immediate suspension of all smart contracts on the platform.

Details of the Hack

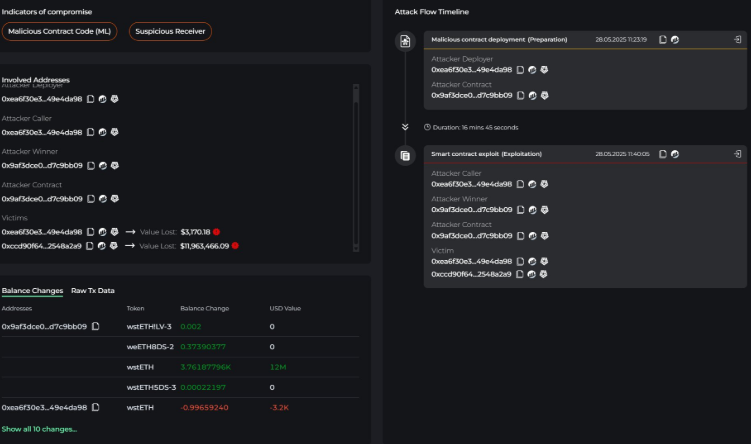

According to cybersecurity firm Cyvers, the exploit occurred at 11:23:19 UTC, funded by a wallet ending in “762B.” The attacker successfully stole:

- 3,761 Wrapped Staked Ether (wstETH)

- Immediately converted it into Ethereum (ETH), worth around $2,635 per token

“We are investigating a potential exploit on Cork Protocol and are pausing all contracts,” said co-founder Phil Fogel in a post on X.

The stolen funds were swiftly moved across wallets, leaving little time for intervention.

Industry Impact & Growing Concerns

This breach highlights the ongoing vulnerability of DeFi platforms. Despite advancements in Web3 technology, smart contract security remains a critical weakness.

Cybersecurity concerns continue to erode user trust and call for stronger auditing and proactive monitoring mechanisms across decentralized ecosystems.

Key concerns raised by the incident:

- Lack of multi-layer protection

- Delayed threat detection

- Immediate asset liquidation by attackers

Cork Hack Follows $223M Cetus Exploit

Just six days earlier, Cetus DEX — built on the Sui network — suffered a $223 million hack. Although Sui validators froze most of the funds, the situation sparked debates about network centralization.

Cetus has offered a $6 million bounty to ethical (white hat) hackers to help recover the remaining stolen assets.

Call for Enhanced Security Standards

The Cork Protocol hack adds to a growing list of high-profile exploits in 2025, as industry leaders urge stronger preventative measures.

Hacken CEO warned that “no real progress” has been made in crypto security, even as April hacks alone totaled $357 million.

Conclusion

Cork Protocol’s $12 million loss underscores the urgent need for enhanced DeFi security. As attacks continue, platforms must prioritize rigorous smart contract audits, real-time threat detection, and user fund protection mechanisms.

Until the industry evolves stronger defenses, trust in DeFi will remain at risk.