Ethereum (ETH) rebounded above the $2,600 mark following a sharp intraday decline, signaling renewed investor interest and short-term confidence. Despite recent volatility, institutional demand and ongoing network enhancements may provide tailwinds for a potential move toward $3,000.

ETH Experiences High Volatility With Quick Recovery

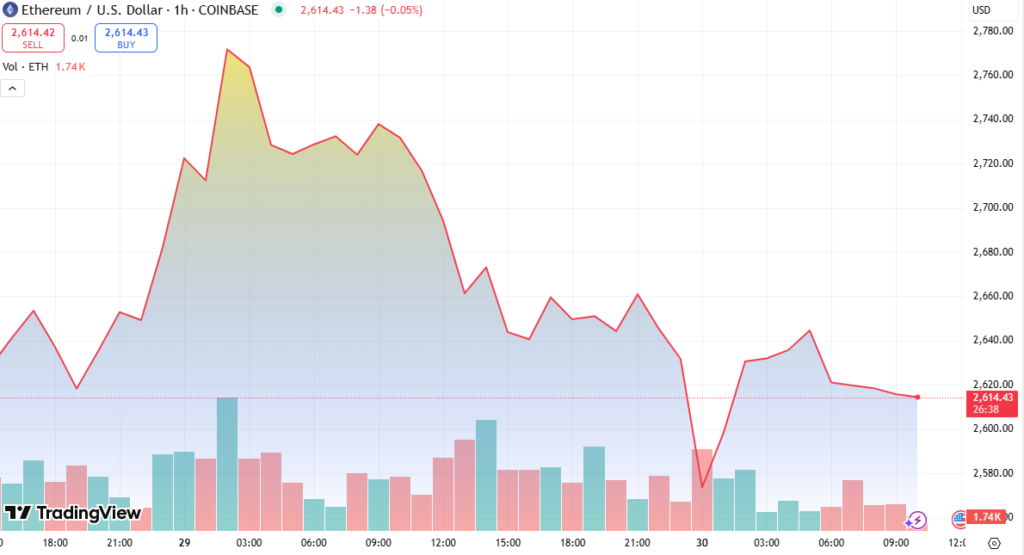

On May 29, Ethereum’s price experienced a 6% decline from $2,724.737 to a low of $2,569.766, driven by broader market uncertainty and intensified sell-offs. However, strong support at the $2,570 level enabled ETH to recover to $2,621.656, reflecting bullish resilience.

Short-term support formed at $2,570, where buying pressure re-entered the market, allowing ETH to stabilize.

A volatile trading session saw prices spike again to an intraday high of $2,642.839 before closing just above $2,620, signaling a potential shift in short-term momentum.

Technical Outlook: Key Levels to Watch

Technical Analysis Highlights

- ETH opened at $2,724.737 before dropping sharply.

- The low of $2,569.766 represented a 6% pullback, triggering increased market activity.

- Recovery to $2,621.656 showed renewed investor confidence.

- Volatile pattern observed with a rebound high of $2,642.839 before session end.

- Elevated trading volumes suggest accumulation at lower price zones.

The formation of strong intraday support and significant recovery volume reinforces the probability of a continuation to higher resistance levels.

Investor Sentiment and Macro Drivers

This recovery occurs amid growing institutional interest and positive developments in Ethereum’s ecosystem, such as upgrades to scalability and staking efficiency. The broader market’s resilience—despite macroeconomic pressures like inflation and trade policy shifts—is also helping Ethereum regain traction.

Analysts project a potential move toward $3,000 if Ethereum maintains support and global sentiment continues to improve.

Conclusion

Despite recent turbulence, Ethereum’s quick rebound above $2,600 highlights underlying investor confidence and network strength. The $2,570 level now acts as a critical support zone, with continued interest from both retail and institutional buyers.

If momentum persists and trading volumes stay elevated, Ethereum could test the $2,700–$3,000 range in the coming sessions.