Crypto Market Shaken by Macro Events

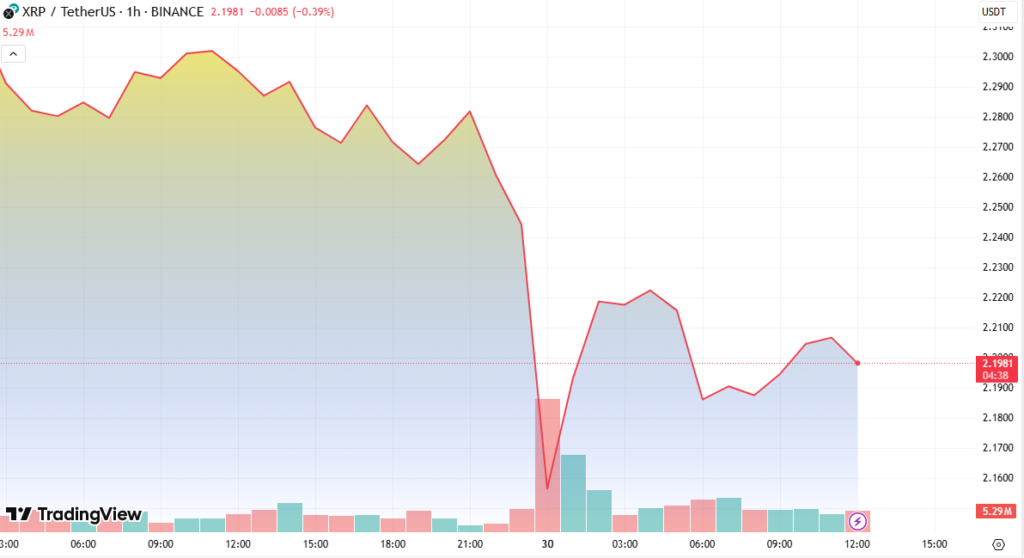

XRP experienced a sharp 6.16% drop, falling from $2.305 to $2.163, as global economic tensions triggered a high-volume market correction. This came in the wake of a U.S. court decision overturning Trump-era tariffs, which rippled across financial markets, denting investor confidence and reducing the total cryptocurrency market capitalization by 3.1%, now standing at $3.35 trillion.

Volume Surge Points to Capitulation

During the selloff, XRP trading volume surged to 174.7 million units, nearly four times the 24-hour average, indicating a wave of capitulation selling. Prices briefly rebounded to $2.22 after finding initial support at $2.16, but struggled to break key resistance.

Resistance at $2.23 remains a critical barrier to any sustained recovery.

The hourly chart shows a V-shaped recovery attempt, but gains were capped near $2.204, leading to a consolidation phase between $2.195 and $2.196.

Institutional Interest Signals Long-Term Potential

Despite the short-term pressure, there are positive signs from institutional players. Renewable energy firm VivoPower raised $121 million to create an XRP-focused treasury reserve, a first-of-its-kind move among publicly listed companies.

In addition, China-based Webus International announced plans to raise up to $300 million to launch a strategic XRP reserve, highlighting growing interest from institutions in holding XRP as part of treasury diversification strategies.

These developments may offer long-term support for XRP even as the short-term outlook remains uncertain.

Technical Outlook: $2.31 Support Is Crucial

Market analysts are closely watching the $2.31 support level. If XRP fails to regain and maintain this threshold, there is a risk of a further 16% decline toward $1.96, a price level not tested in recent weeks.

A failure to hold above $2.31 could send XRP back to $1.96, signaling deeper downside risk.

Summary

- XRP fell 6.16%, from $2.305 to $2.163 amid global economic concerns.

- Trading volume spiked to 174.7M units during the selloff.

- Key support is at $2.16, with resistance at $2.23 blocking recovery.

- Institutional investments, including VivoPower’s $121M XRP treasury, could help stabilize prices.

- A drop below $2.31 may trigger a 16% correction to $1.96.