Alarming Rise in Crypto Fraud Targeting Retail Users

\

Leading global cryptocurrency exchange MEXC has reported a 200% increase in fraudulent trading activity during the first quarter of 2025, according to its recently released quarterly report.

Between January and March, the platform identified 80,057 organized fraud attempts involving more than 3,000 criminal syndicates. The nature of these scams ranged from market manipulation and wash trading to the use of automated trading bots that exploit users through unfair execution tactics.

“This level of organized exploitation is unprecedented and deeply concerning,” said MEXC in its analysis.

India Leads in Detected Fraud Cases

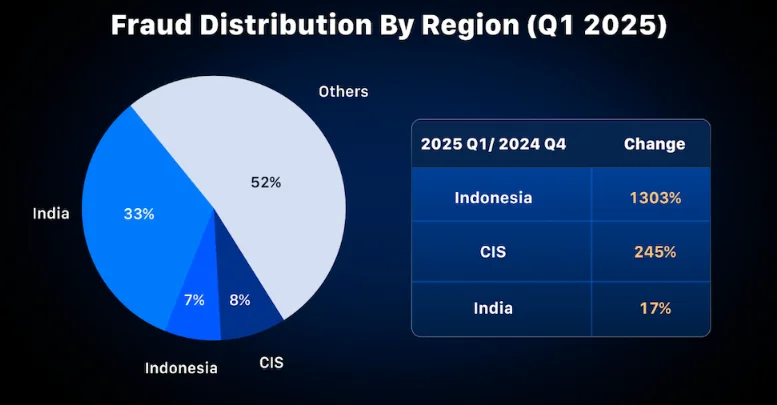

The report noted that the surge in fraudulent activity was most pronounced in India, where nearly 27,000 user accounts were flagged for suspicious behavior. This was followed by:

- 6,404 flagged accounts in the CIS (Commonwealth of Independent States) region

- 5,603 flagged accounts in Indonesia

India, the CIS region, and Indonesia accounted for over half of the flagged accounts globally, highlighting key geographies for rising crypto abuse.

Social Engineering Scams Driving the Trend

According to Tracy Jin, Chief Operating Officer at MEXC, the dramatic rise in fraudulent behavior is largely attributed to social engineering tactics. These scams often involve manipulating users through deceptive schemes, such as fake investment opportunities or impersonation of exchange representatives.

“A steady stream of unsuspecting victims are being funneled into fraudulent schemes,” said Jin. “Education and proactive detection are now more critical than ever.”

Key Forms of Detected Fraud

MEXC outlined several types of fraud that contributed to the increase:

- Market manipulation through coordinated trading groups

- Wash trading designed to fake market activity and inflate volumes

- High-frequency bot trading that creates unfair trading environments for retail users

These activities not only harm individual investors but also undermine trust in crypto markets.

Conclusion: A Call for Industry-Wide Vigilance

MEXC’s findings highlight an urgent need for stronger fraud prevention mechanisms and user education across the crypto industry. As fraud tactics become increasingly sophisticated, platform accountability and regulatory coordination will play a crucial role in maintaining market integrity.

The 200% rise in Q1 fraud signals a growing threat that all crypto platforms must address head-on.