Bitcoin Cash (BCH) staged a sharp rebound following recent market turbulence, rising 6.4% over the past 24 hours. The altcoin found strong buying interest after dipping to critical support levels, reflecting broader resilience in the crypto market despite intensifying global trade tensions.

BCH Finds Strong Support at $391 After Steep Drop

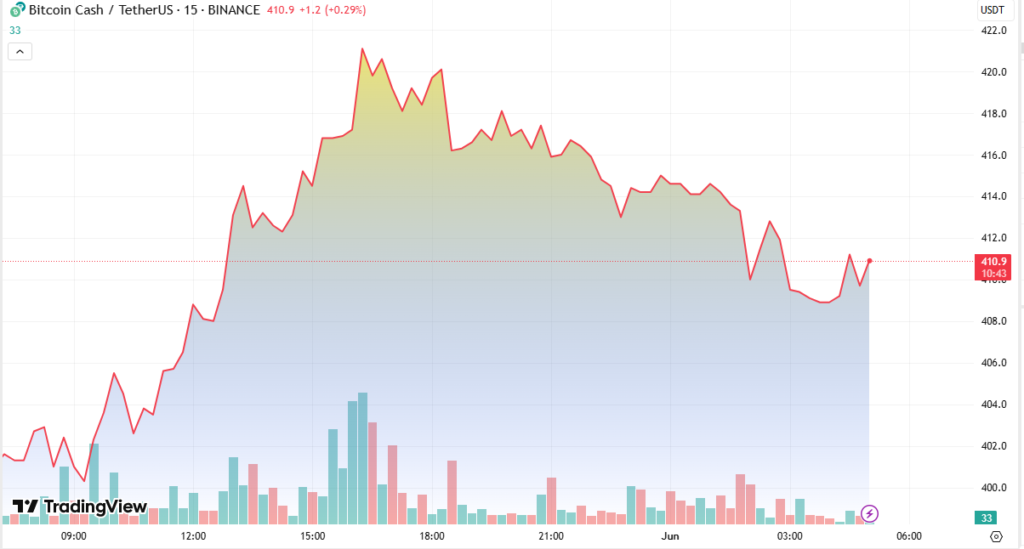

Over a 24-hour trading period, Bitcoin Cash experienced a price range of $25.07, falling to a low of $391.65 before rallying back above $416.95.

The price formed a classic V-shaped recovery pattern, signaling robust demand and technical support. The bounce was fueled by high volume accumulation between 01:00 and 04:00 UTC, where bulls defended the $391 zone.

A significant breakout occurred at 13:00 UTC, when BCH surged on the highest hourly volume of the session—28,068 BCH traded—confirming strong bullish interest.

Resistance Flips Into Support as Bull Flag Emerges

After the impulse move, Bitcoin Cash entered a consolidation phase. Price action formed a bull flag pattern, typically a continuation signal in technical analysis.

The previous resistance at $409.80 is now acting as new support, and bulls are targeting a move above the $422–$425 zone. Volume during consolidation has declined, which often precedes a renewed breakout.

The $413.00–$413.50 zone is critical; holding this level could reinforce bullish momentum and attract fresh entries._

Geopolitical Tensions Add Macro Pressure on Markets

The rebound in BCH occurs against the backdrop of heightened US-China tariff tensions, which have introduced widespread uncertainty across financial markets. Rising U.S. Treasury yields also signal systemic economic stress, creating a challenging environment for risk assets like cryptocurrencies.

However, Bitcoin Cash’s recovery demonstrates relative strength compared to peers and suggests investor confidence in key technical zones.

Technical Indicators Signal Potential Upside

Momentum indicators are turning positive, and if support at $413 holds, analysts expect a possible extension toward $440 in the short to mid-term.

Traders are advised to monitor volume dynamics and macro developments as they will likely influence whether BCH can sustain its upward trajectory.

A breakdown below $409.80 would invalidate the bullish structure and open the door to retesting lower levels near $400.