The decentralized lending protocol’s token retreats toward a critical demand region while broader market volatility intensifies and momentum indicators deteriorate.

AAVE declined 8% in the latest trading session, sliding toward a pivotal support zone after repeated failures to reclaim a major resistance cluster near the $240–$260 range. Despite earlier attempts to stabilize, the token continues to face heavy overhead supply, with technical signals revealing a shift in short-term market structure. Analysts note that AAVE’s current behavior reflects a mixture of exhausted bullish momentum, deteriorating trend strength, and sustained selling pressure across altcoins.

AAVE Price Tests Critical Technical Levels

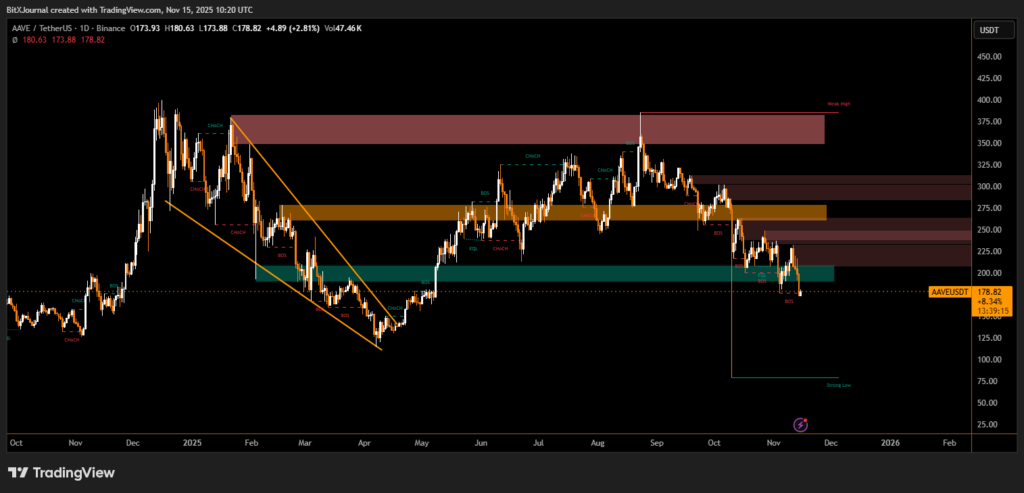

The chart shows AAVE breaking down from the $200–$205 support, a level that had provided stability throughout the past month. The failure to maintain this zone resulted in a move toward the $170–$180 demand block, an area that historically attracts buyer interest.

Multiple break-of-structure (BOS) and change-of-character (CHoCH) markers highlight weakening trend conditions. The token’s inability to reclaim the mid-range supply at $220 has turned that zone into a firm resistance layer. Below the current price, the next major liquidity pocket sits near $155–$165, representing the lower boundary of the last accumulation zone.

BitXJournal on-chain market analyst commented, “The compression beneath resistance zones left AAVE vulnerable. Once the candle closed below $200, sellers seized momentum, forcing price back into the broader demand area.”

Market Sentiment Dampens Recovery Prospects

While market-wide volatility continues to pressure altcoins, AAVE is exhibiting amplified sensitivity to resistance retests. The rejection from the $250 supply region, visible on the chart, underscores the dominance of sellers in the current environment.

BitXJournal technical strategist added, “The market is reacting to deep liquidity levels. Unless AAVE forms a strong rejection wick around $175, the risk of a deeper sweep remains elevated.”

Still, some analysts see potential for stabilization if the $170 demand block holds, pointing to a historical pattern where AAVE rebuilds momentum after extended pullbacks. A decisive break back above $200 would be the earliest signal of renewed strength.

The coming sessions will determine whether AAVE can hold the $170–$180 support zone, a level that could shape the next directional move. Maintaining this floor may provide the foundation for a recovery, while failure to defend it could expose the token to a deeper retracement toward the $150 region.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.