Stani Kulechov, founder of Aave, believes decentralized finance could unlock up to $50 trillion in tokenized “abundance assets” by 2050, reshaping how capital flows into infrastructure and emerging technologies.

While nearly $25 billion in real-world assets have already been tokenized — largely US Treasurys, private credit and real estate — Kulechov argues the next phase of growth will come from assets tied to scalable production, particularly solar energy. He estimates solar alone could represent $15 trillion to $30 trillion of the projected market over the next 25 years.

In a post to X on Sunday, Kulechov said ;

Tokenized Infrastructure Could Boost Capital Efficiency

Kulechov outlined a model in which a $100 million solar project could tokenize its equity or debt, borrow against it onchain and recycle capital into additional developments. Investors, in turn, could access diversified yield products backed by renewable infrastructure and trade positions more freely than in traditional long-term financing structures.

Beyond solar, he pointed to battery storage, robotics, vertical farming, semiconductors and advanced manufacturing as candidates for tokenization.

Aave’s Market Position and Token Performance

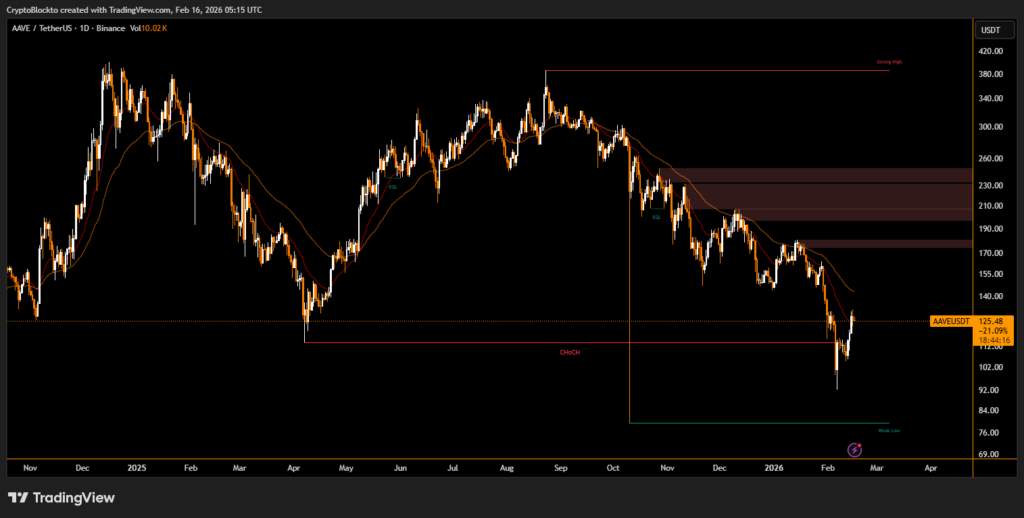

Aave remains the largest DeFi lending protocol with roughly $27 billion in total value locked. However, the AAVE token trades near $126, down over 15% in 2026 and about 81% below its 2021 peak, reflecting broader crypto market weakness.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.