A significant Aave loan, backed by approximately 2.3% of the total AAVE supply, entered liquidation on Thursday as the crypto market experienced sharp declines. Onchain data shows that around $2 million in AAVE collateral was seized across four separate liquidation transactions to cover nearly $2 million in USDC debt.

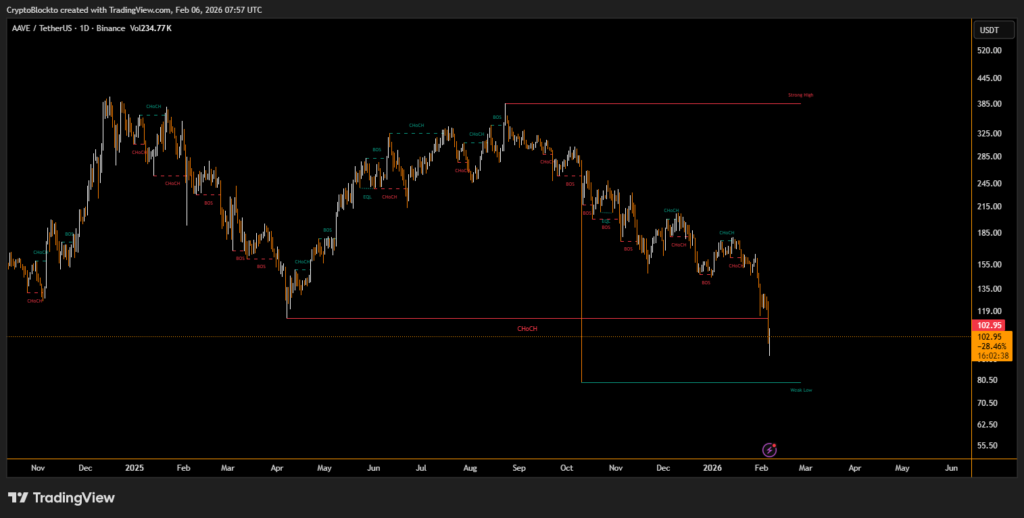

Originally, the loan was overcollateralized with roughly $28.4 million in AAVE, secured by 355,093 tokens. Rapid liquidations occurred when the AAVE price dropped to $104, and additional liquidations followed as the price slipped further to $103. The most recent data shows AAVE trading at $105.60, down 15% on the day, while Bitcoin and Ethereum also fell over 13%, hitting multi-month lows.

How Aave Liquidations Work

Loans on Aave are subject to liquidation once their “Health Factor” falls below 1, which can happen due to price fluctuations or accrued interest. Liquidators repay part of the debt and claim collateral at a discount. The protocol applies a liquidation penalty, but only liquidates enough to restore the loan to a healthy range.

AAVE is currently trading at $103.60, down 15% on the day.

This loan currently maintains a collateral ratio of roughly 132% with a health factor near 1. The borrower initially deposited $8.73 million worth of AAVE in 2024, taking out USDC and repaying portions multiple times. Starting in 2025, the loan amounts increased, ranging from $1 million to $5 million, prompting repeated repayments and liquidations.

Founder of Aave, who recently disclosed buying a $30 million mansion in London, said on X.

Speculation about the borrower’s identity surfaced online, but Aave’s founder clarified that he was not involved in the transaction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.