Strong DeFi Momentum Fuels AAVE Recovery

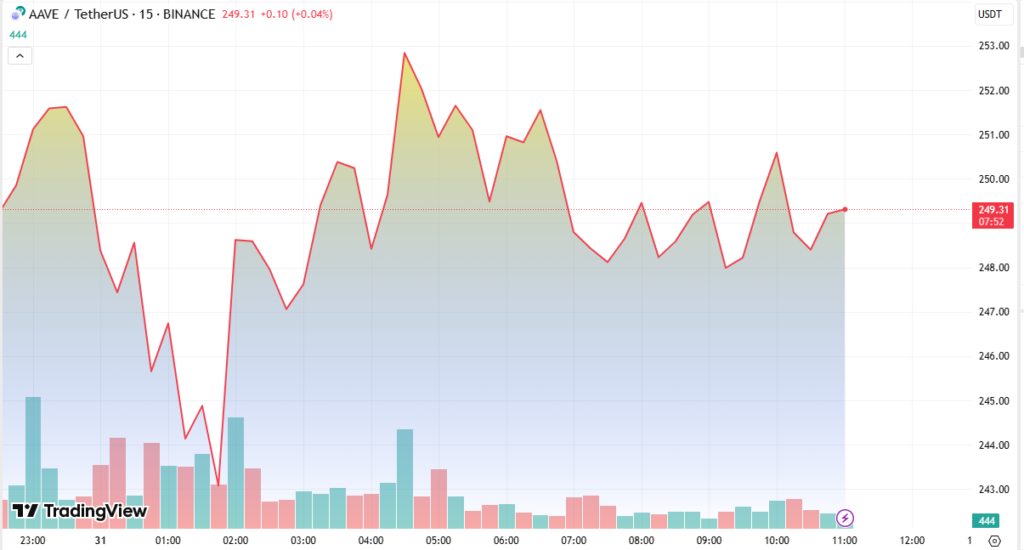

AAVE has rebounded strongly from a 15% price decline, showing renewed strength as decentralized finance (DeFi) yield markets gain traction. The token recovered from a low of $240 to over $250, driven by increased buying interest and favorable market developments within the DeFi space.

AAVE’s resilience highlights investor confidence in decentralized lending platforms, even as macroeconomic tensions weigh on broader market sentiment.

DeFi Sector Growth Supports Price Action

The recovery coincides with a surge in total value locked (TVL) across DeFi protocols, which rose to $178.52 billion. AAVE continues to dominate the lending segment, commanding a market-leading $25.41 billion in TVL.

AAVE maintains a 45% market share in decentralized lending, reinforcing its position as the leading protocol in the space.

Meanwhile, uncertainty in global trade—sparked by reports of China breaching trade agreements and the U.S. reversing tariff policies—has created volatility across risk assets. Despite this, DeFi protocols like AAVE are gaining strength through product innovation and increased usage.

Ethereum Foundation Backs AAVE’s GHO Stablecoin

A significant development supporting AAVE’s rebound was the Ethereum Foundation’s (EF) borrowing of $2 million in GHO, Aave’s decentralized stablecoin. The loan was collateralized using ETH, demonstrating EF’s strategic use of crypto assets while contributing to Aave’s ecosystem.

GHO is fully overcollateralized, and interest payments from this loan flow back into Aave’s DAO treasury, promoting a sustainable, community-driven model.

Technical Analysis Signals Strength

AAVE formed high-volume support at $242.70, with increased activity during the 16:00–17:00 and 01:00–02:00 hours. Price action displayed a bullish ascending triangle, indicating accumulation, and a cup-and-handle formation emerged, suggesting bullish continuation.

- Resistance formed at $253.75 after a peak at $255.96

- Short-term consolidation occurred near $249, hinting at continued buyer interest

- A volume surge during 07:51–07:52 marked a sharp rally, reinforcing support

AAVE’s ability to hold key support and form bullish patterns points to possible upside continuation, especially if it breaks through the $250 resistance zone.

Positioned for Growth in DeFi Expansion

As tokenized yield markets attract growing attention, AAVE’s integration with protocols like Pendle and its strong governance structure make it a cornerstone of DeFi’s next growth phase. Its continued dominance, innovation, and ability to weather macroeconomic headwinds set the stage for potential long-term appreciation.