Africa Bitcoin Corporation aims to reshape capital markets with BTC-backed financial services

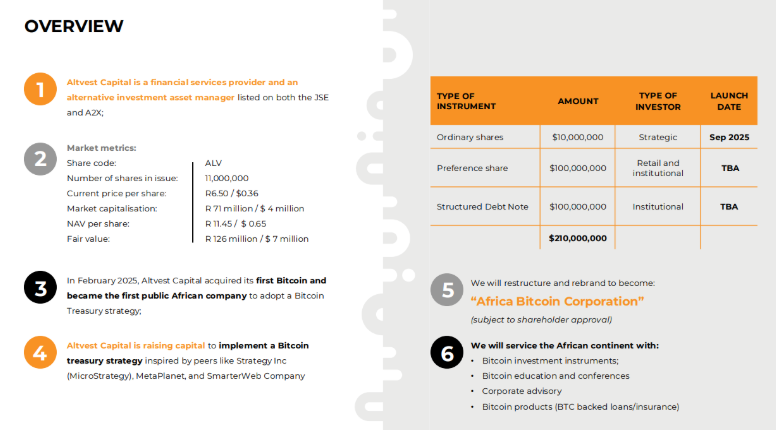

Africa Bitcoin Corporation (ABC), formerly known as Altvest Capital, has become the first publicly listed Bitcoin treasury company on the Johannesburg Stock Exchange (JSE). The firm’s leadership believes Bitcoin is not only a balance sheet asset but a solution to Africa’s deeper monetary challenges.

ABC has set out to raise $210 million through preferential share offerings and structured debt notes to build its Bitcoin holdings. So far, the company has secured 11 million rand ($633,000) in its first phase, with a goal of raising $11 million before scaling up.

CEO Warren Wheatley described the move as a “natural evolution”, calling Bitcoin the “ultimate alternative asset” that strengthens the company’s ability to support entrepreneurs and small businesses across South Africa.

Beyond Balance Sheets

Chairman Stafford Masie emphasized that ABC is not a “pure play” Bitcoin company but an operating business leveraging BTC to expand services:

“Holding Bitcoin allows us to continue investing and help small enterprises raise capital. This Bitcoin play gives us more muscle relative to our existing operations.”

The company aims to offer Bitcoin-backed financial services, including credit, savings, and structured investment products, bridging the gap between grassroots users and institutional investors.

Bitcoin’s Value in Africa

While Bitcoin is often treated as a speculative investment in the West, Masie stressed its life-saving utility in developing nations facing currency debasement and inflation.

“In Africa, when financial services don’t work, people die. We live that reality. That’s who we are. Bitcoin is approached from a human necessity, not just a financial instrument.”

He pointed out that rising costs of essentials like food and electricity are symptoms of a “broken monetary system”, not simply political issues.

“Your groceries are not getting more expensive; the money is getting weaker.”

A Human-Centered Vision

For ABC, building a Bitcoin treasury is more than a financial strategy. Masie explained:

“If we can get this right, we can solve problems inherent to Bitcoin’s value proposition. That’s why we say Bitcoin was made for us.”

By positioning itself at the intersection of grassroots adoption and capital markets, ABC hopes to offer exposure to BTC for both retail users and institutional investors struggling to access the asset class.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.