Nasdaq-listed firm joins TON treasury push amid token slump

AlphaTON has added $30 million worth of Toncoin (TON) to its balance sheet, becoming the second Nasdaq-listed company to adopt the asset as part of its digital treasury strategy. The move comes despite Toncoin’s 13% monthly decline and a broader selloff in crypto treasury stocks.

AlphaTON’s Toncoin accumulation strategy

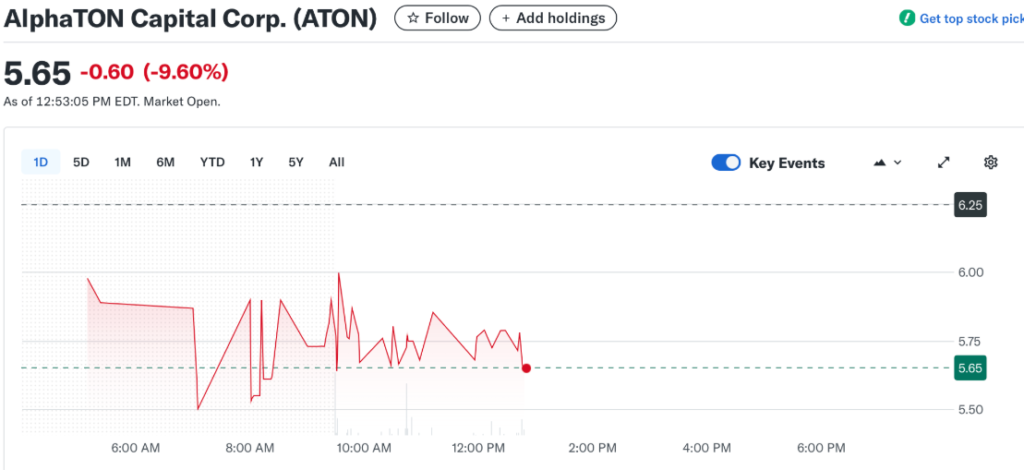

Formerly Portage Biotech, AlphaTON announced the purchase on Thursday, noting plans to expand its Toncoin holdings to $100 million by the end of 2025. The company’s stock fell 9.6% in 24 hours following the news, underscoring investor caution toward firms making heavy crypto pivots.

Brittany Kaiser, a former board member of Gryphon Digital, is leading the shift. According to filings with the U.S. SEC, AlphaTON has historically focused on immune oncology treatments but now considers a Toncoin treasury as one of its “primary lines of business.”

Growing competition among TON treasuries

AlphaTON follows TON Strategy Co., which launched its treasury in August with a massive $713 million purchase of 217.5 million TON tokens. However, TON Strategy shares have struggled, sliding 65% in the past month.

Both companies are accumulating and staking TON but differ in approach. AlphaTON highlights ecosystem investments, while TON Strategy emphasizes a no-leverage, long-term holding model.

A Standard Chartered research note cautioned that “market saturation is driving net asset value compression,” warning that smaller treasury firms could face liquidity pressures if the downturn extends.

Toncoin adoption vs. price performance

The Open Network, created by Telegram and now run independently by the TON Foundation, has seen a surge in adoption. In January, Telegram made TON the exclusive blockchain for its Mini App ecosystem, boosting network activity.

Despite these developments and more than $400 million in VC investment earlier this year, Toncoin’s price has failed to rebound. At press time, TON traded at $2.75, down 50% year-to-date.

The expansion of digital asset treasuries (DATs) beyond Bitcoin and Ethereum into altcoins like Toncoin, Solana, and BNB reflects a diversification trend among public companies. Yet, the steep underperformance of DAT stocks compared to the tokens they hold has raised doubts about the sustainability of this model.

As one analyst put it: “Treasuries expected to outperform their underlying assets, but the opposite has been true in 2025. The risk is that debt-driven selling could intensify volatility in the next downturn.”

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.