Momentum Improves After Weeks of Decline, but Strong Resistance Looms Ahead

Aptos (APT) moved higher on Tuesday, climbing nearly 4% to trade around $2.87 after dipping toward multi-month lows earlier this week. The modest rise marks a rare pause in a prolonged downtrend that has dominated the token’s price action since early autumn. Market analysts suggest that the latest bounce may signal early accumulation, though the broader structure still leans bearish.

APT Technical Structure Shows Early Signs of Stabilization

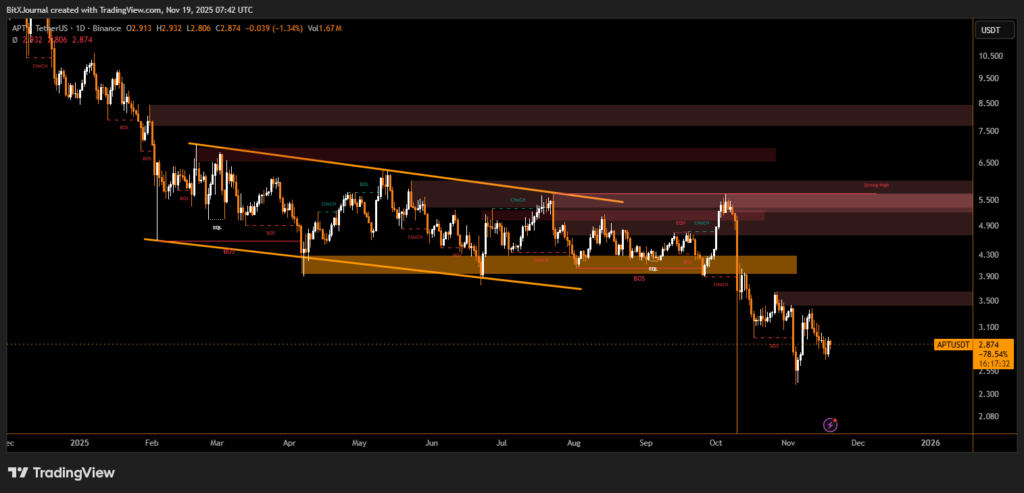

The daily chart reveals APT attempting to recover from a deeper sweep into the $2.70–$2.80 liquidity zone, an area that repeatedly attracted buyers during past corrective phases. The sharp rebound from this band highlights the presence of reactive demand even as the wider market remains cautious.

APT continues to trade inside a long-lasting descending channel that has guided price action for several months. Multiple rejections from the upper boundary confirm heavy overhead supply near the $4–$5 range. BitXJournal market technician reviewing the setup noted, “The prevailing trend remains down, but compression within the channel is tightening. That usually precedes either a breakout or a decisive continuation move.”

The chart also shows a significant high-timeframe supply block around $4.30–$4.90, a zone that capped every recovery attempt since late summer. For the current bounce to develop into a larger reversal, APT would need to reclaim at least the mid-channel level, which currently aligns near $3.20.

BitXJournal analyst added, “Short-term momentum is improving, but the price is still trading below several key structure breaks. The reaction at $2.80 is constructive, yet follow-through remains essential.”

The uptick in price comes as several altcoins attempt to stabilize following widespread volatility earlier in the month. Trading volume in APT remains relatively modest, reflecting a market still searching for direction rather than signaling aggressive accumulation.

If APT holds above $2.80, a push toward the psychological $3 mark appears achievable, potentially extending to the $3.20 resistance area. A failure to maintain current levels, however, could expose the token to another retest of the lower channel boundary.

For now, the market is watching whether today’s bounce becomes a foundation for recovery or just another brief pause in the ongoing downtrend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.