Arcadia Finance, a decentralized finance (DeFi) platform on the Base blockchain, was exploited on July 15, 2025, resulting in the loss of $2.5 million in crypto assets. The attacker used a vulnerability in the protocol’s Rebalancer contract to steal funds, which were then converted into Wrapped Ethereum (WETH) and bridged to Ethereum mainnet.

How the Exploit Happened

According to an alert from blockchain security firm Cyvers, the exploit occurred at 04:05:58 UTC. The attacker deployed a malicious contract and quickly executed a swap using arbitrary swapData parameters, bypassing intended protocol logic. This allowed access to user vaults and enabled unauthorized asset transfers.

The stolen tokens included:

- 2.3 million USDC

- 227,000 USDS

In total, $2.5 million was drained, swapped to 199 WETH and 965.8 million AERO tokens, and moved through 12 impacted addresses.

“The attacker bridged the funds from Base to Ethereum and used intermediary wallets to obfuscate the trace,” said Cyvers, highlighting the attacker’s attempt to avoid detection through fragmentation and DEX mixing.

Arcadia Finance Response and User Advisory

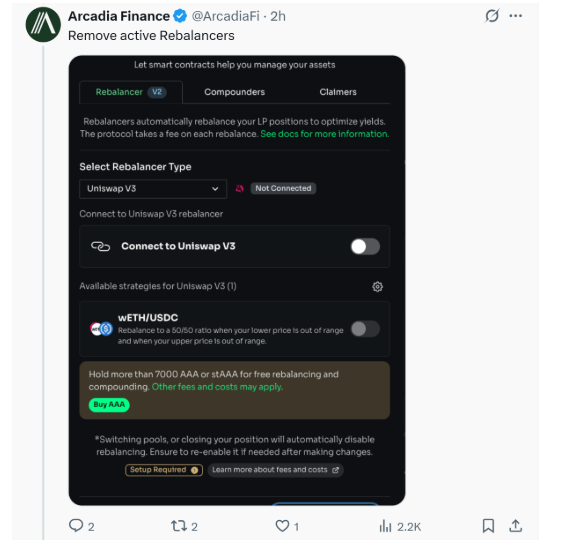

The Arcadia team acknowledged the breach in a statement on X (formerly Twitter), confirming:

“The team is aware of unauthorized transactions via a Rebalancer. Remove all permissions for asset managers. More information will follow.”

Users were urged to revoke permissions previously granted to Arcadia’s asset managers or rebalancer contracts immediately to prevent further damage.

Security Recommendations

Cyvers suggested the following actions:

- Blacklist all involved addresses on both Base and Ethereum

- Notify centralized exchanges and bridges to monitor and block suspicious transfers

- Share suspicious activity reports with law enforcement agencies

Industry-Wide Context: Crypto Hacks Soar in 2025

This incident adds to the growing trend of DeFi vulnerabilities exploited in 2025. According to CertiK, more than $2.47 billion has been stolen in the first half of the year across various hacks, scams, and protocol breaches — a 3% rise compared to 2024.

While Q2 saw $800 million in losses, it marked a 52% drop from Q1, suggesting some improvement in security postures — but not enough to deter sophisticated attackers.

Final Thoughts

The Arcadia Finance exploit highlights persistent risks in DeFi smart contracts, especially those enabling asset management and automatic trading logic. With attackers becoming increasingly strategic and stealthy, platforms must reinforce real-time monitoring, smart contract audits, and user permission safeguards.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.