The investment firm adds to its positions during market weakness, acquiring $7.6M in Circle and $1.5M in Bullish as digital asset stocks continue to slide.

Ark Invest has expanded its footprint in crypto-related equities once again, purchasing a combined $9.1 million in Circle and Bullish stock during the latest market pullback. The acquisition comes as broader digital asset prices remain under pressure, with Bitcoin hovering near $87,500, prompting strategic accumulation across Ark’s managed funds.

Ark Invest Adds to Circle and Bullish Positions

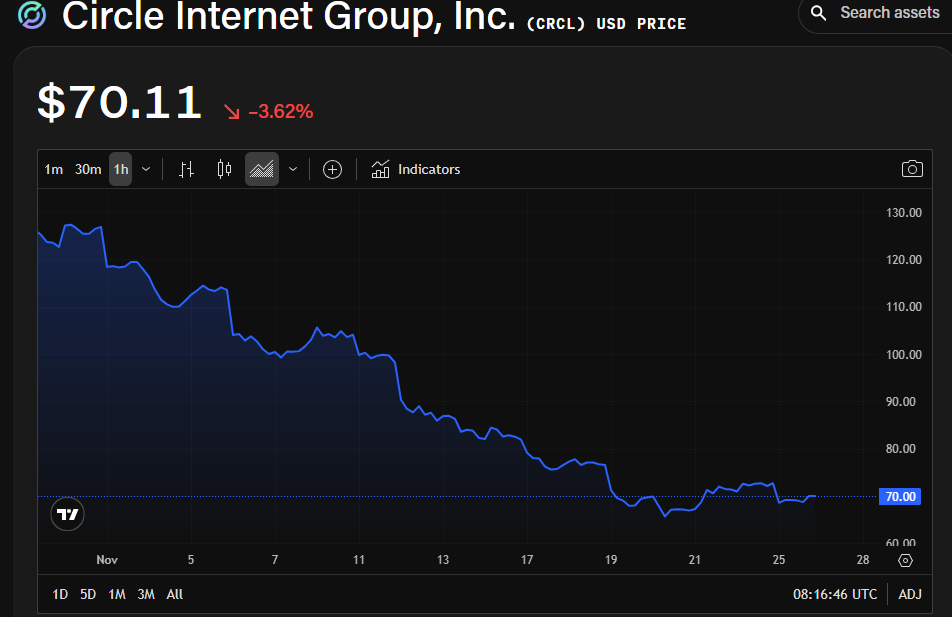

On Nov. 25, Ark acquired $7.6 million in Circle (CRCL) and $1.5 million in Bullish (BLSH). Both stocks were trading lower on the day, extending declines seen across the crypto equity sector.

Circle ended the session at $70.11, down 3.62%, while Bullish closed at $40.50, a drop of 2.41%.

The purchases are part of a broader buying pattern. Just five days earlier, Ark executed a large-scale dip-buy, accumulating hundreds of millions of dollars in crypto-linked equities following Bitcoin’s recent sharp downturn. The firm’s continued activity signals confidence in the long-term growth trajectory of digital asset infrastructure companies.

Ark Strengthens Key Crypto Holdings

Ark now holds $151.8 million worth of Bullish shares across its ETFs. The firm’s two largest positions in the crypto sector remain unchanged:

- Coinbase (COIN) — representing 4% of Ark’s total holdings, valued at approximately $506.4 million.

- Circle (CRCL) — making up 2% of total holdings, at roughly $255 million.

These allocations illustrate Ark’s ongoing conviction in companies directly tied to the digital asset economy, even as short-term volatility weighs on valuations.

Crypto Stocks Continue to Slide

The latest purchases occurred during a period of weakness for the crypto market. Bitcoin, which recently endured a significant liquidation-driven decline, traded around $87,500 during Ark’s acquisition. The broader sector has been under pressure as investors reassess risk appetite following heightened leverage unwinds.

Despite these conditions, Ark’s approach suggests the firm views the downturn as an opportunity.

Accumulating during market softness signals a strategic long-term stance on the future of digital finance and blockchain infrastructure.

Ark Invest’s $9.1 million addition to Circle and Bullish reflects a continued strategy of buying into crypto equities during periods of weakness. As digital asset volatility persists, Ark’s deepening exposure underscores its commitment to high-conviction positions in core crypto companies and its belief in the sector’s long-term expansion.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.