Cathie Wood’s ARK Invest increased its exposure to crypto-related stocks during the late-January market downturn, adding positions in Coinbase, Circle and Bullish while digital asset prices moved lower.

ARK Adds Coinbase Shares as Crypto Stocks Slide

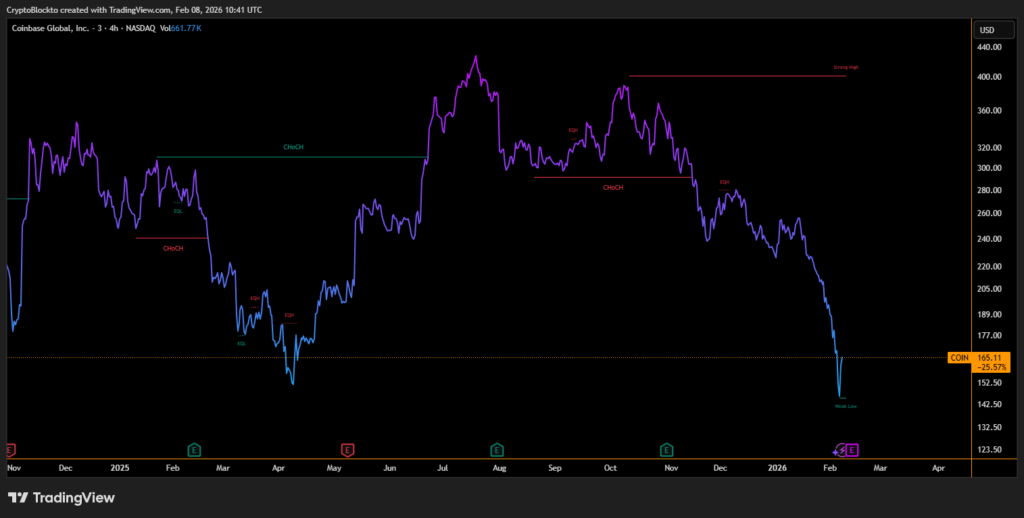

Daily trading disclosures show the ARK Innovation ETF and the ARK Fintech Innovation ETF together purchased more than 42,000 shares of Coinbase Global, representing roughly $9.4 million in value. The buying came as Coinbase shares fell nearly 3% in a single session, underperforming both Bitcoin and Ether during the broader fourth-quarter pullback.

ARK also added significant exposure to Circle Internet Group, acquiring a combined 129,000-plus shares across its funds, worth about $9.2 million. Circle’s stock was largely flat on the day, while shares of Bullish declined around 2% as ARK added approximately $3.2 million to that position.

Crypto Exposure Weighs on ARK ETF Performance

Crypto-linked equities were a key drag on ARK’s performance in the final quarter of 2025. Coinbase, in particular, emerged as the largest detractor across multiple ARK funds as centralized exchange trading volumes declined following an October liquidation event. Other holdings, including Roblox, also pressured returns after company-specific guidance weighed on investor sentiment.

Despite near-term volatility, ARK maintains a constructive long-term view. The firm projects the digital asset market could reach $28 trillion by 2030, driven primarily by Bitcoin adoption. Under its assumptions, Bitcoin prices could approach the $1 million level as institutional participation continues to grow.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.