Cathie Wood’s firm increases COIN exposure following Coinbase’s push to become an “everything exchange”

Ark Invest has added to its position in Coinbase shares following the crypto exchange’s recent System Update product rollout, signaling continued conviction in the company’s long-term growth strategy despite ongoing market volatility.

According to fund disclosures, Ark Invest purchased 17,386 additional Coinbase shares, valued at approximately $4.2 million, across three exchange-traded funds. The largest portion went to the flagship innovation fund, with smaller allocations added to its internet and fintech-focused portfolios.

This follows an earlier purchase earlier in the week, bringing Ark’s total recent Coinbase buying to more than $20 million. The firm regularly rebalances holdings to ensure no single position exceeds 10% of any fund, a rule designed to maintain diversification during sharp price swings.

As of mid-December, Coinbase ranks among the top holdings across Ark’s core funds, reflecting its strategic importance within the firm’s high-growth technology thesis.

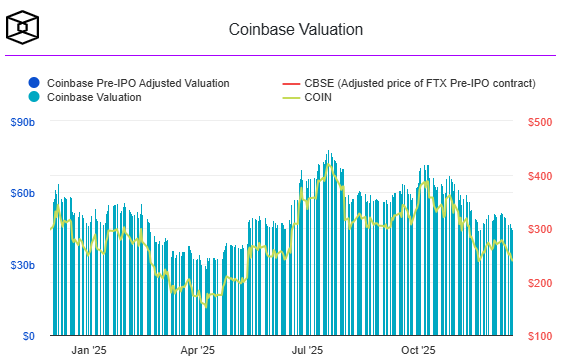

Coinbase shares recently traded around $239, with a market valuation near $45 billion. While the stock remains down year-to-date, Ark’s continued accumulation suggests confidence that current prices do not fully reflect future growth potential.

The purchases came shortly after Coinbase unveiled a broad expansion of its platform. The exchange announced plans to offer stock trading, prediction markets, decentralized exchange access, derivatives, custom stablecoins, and payments, positioning itself as a unified financial platform.

Analysts noted that the rollout materially expands Coinbase’s addressable market, potentially increasing user engagement beyond traditional crypto trading. Several major banks responded positively, reiterating bullish outlooks and highlighting execution clarity rather than speculative vision.

Alongside Coinbase, Ark invested $1.4 million in Solana treasury firm Solmate, reinforcing its selective exposure to blockchain infrastructure despite broader sector weakness.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.