Firm Adds Millions in Crypto-Linked Stocks Amid Expectations of Improving Market Liquidity

Ark Invest has continued expanding its exposure to crypto-related equities, purchasing more than $16 million in Coinbase shares this week as CEO Cathie Wood predicts that tightening financial conditions may ease in the weeks ahead. The firm disclosed buying 62,166 shares of Coinbase across three of its exchange-traded funds, strengthening its position in one of its highest-conviction holdings.

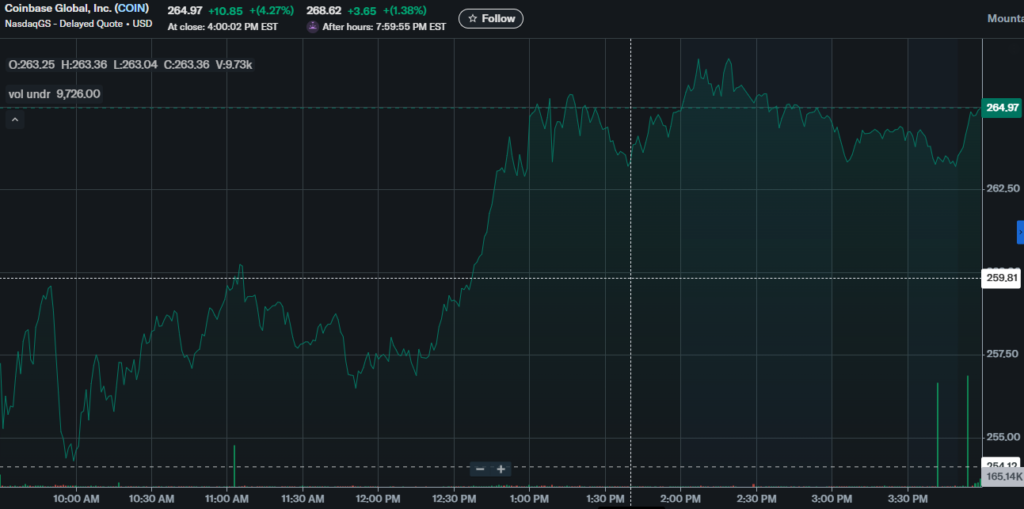

Coinbase now stands as the fifth-largest position in the ARK Innovation ETF, with a market value approaching $400 million. Despite a 4% gain on Wednesday, the stock remains sharply lower over the past month, a decline Ark appears to be treating as an opportunity. The firm also increased its stake in its Bitcoin ETF, adding more than 39,000 shares across multiple funds.

Wood said the recent pullback across crypto and technology stocks is tied to a broader liquidity crunch but argued that conditions could shift soon.

“We are in a bit of a liquidity squeeze — we think it’s temporary,” she noted during a recent investor webinar.

Wood Sees Signs of Cooling Inflation

Wood outlined three factors behind her outlook: expectations that the U.S. Federal Reserve will halt quantitative tightening, the gradual improvement of government funding conditions following the recent shutdown resolution, and the possibility of another rate cut.

“Inflation has declined significantly, and indicators tied to innovation are showing that deflationary forces are building,” she said.

She added that a “real break in inflation” may occur next year as tariff-related pressures fade.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.