BitMEX co-founder urges patience, highlights Bitcoin’s long-term outperformance

BitMEX co-founder Arthur Hayes has warned that Bitcoin investors seeking overnight riches are setting themselves up for disappointment. Speaking in a recent interview with Kyle Chasse, Hayes criticized the mindset of those who expect Bitcoin to deliver luxury lifestyles in a matter of days.

Hayes cautions against “Lambo thinking”

“If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you’re probably getting liquidated because it is not the right way to think about things,” Hayes said. He emphasized that Bitcoin’s true value emerges over time, not in short-term speculation.

Hayes pointed out that while recent buyers may be frustrated with Bitcoin’s price movements, long-term holders remain in profit. “I’m sorry that you bought Bitcoin six months ago, but anyone who bought it two, three, five, or 10 years ago, they’re laughing,” he noted.

Bitcoin vs traditional assets

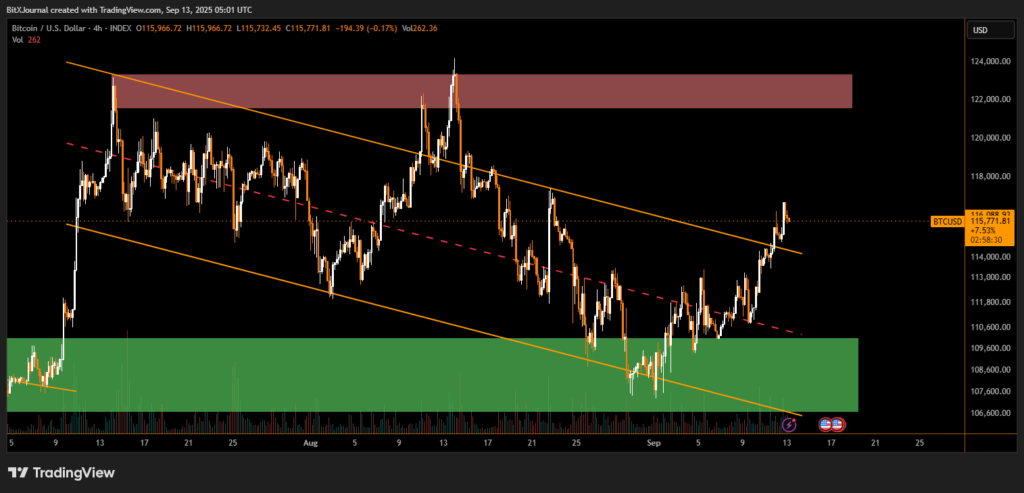

At the time of Hayes’ remarks, Bitcoin was trading near $116,000, below its all-time high of $124,100 reached on August 14. Meanwhile, gold and the S&P 500 both hit fresh records this week, at $3,674 and $6,587 respectively.

But Hayes dismissed comparisons, arguing that Bitcoin has been the best-performing asset in the context of global currency debasement. “Bitcoin is the best performing asset when you think about currency debasement ever,” he said, adding that traditional markets look far weaker when adjusted for gold or Bitcoin.

Long-term perspective remains bullish

Data from Curvo shows Bitcoin has delivered an average annualized return of 82.4% over the past decade—a performance Hayes describes as “ridiculous” compared with other asset classes.

“If you deflate things by Bitcoin, you can’t even see it on the chart,” Hayes argued, reinforcing his view that Bitcoin should be measured over years, not months.

In April, Hayes projected that Bitcoin could reach $250,000 by year-end, a forecast echoed by Unchained Market Research’s Joe Burnett in May. Despite short-term volatility, Hayes insists that Bitcoin’s long-term trajectory remains unmatched.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.