Middle East Conflict Triggers Sharp Decline in Altcoins

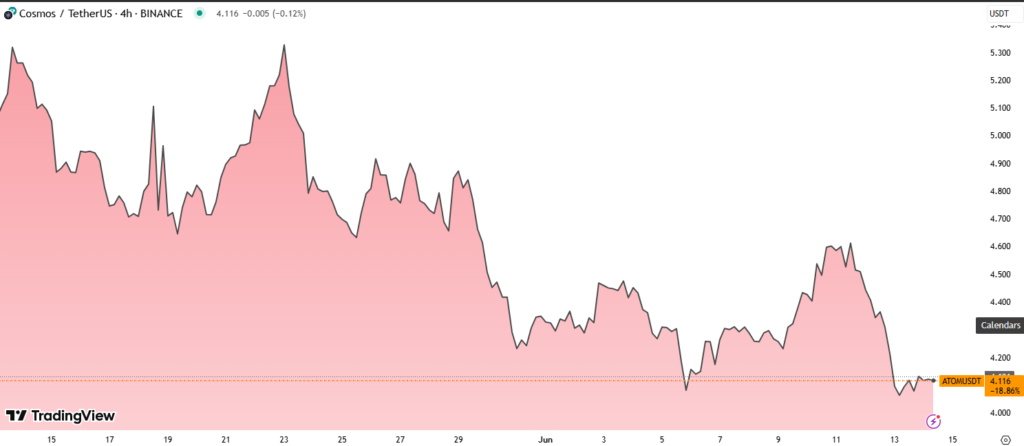

Cosmos (ATOM) tumbled 9.25% in the last 24 hours, dropping from $4.43 to an intraday low of $4.02, as the broader crypto market responded to heightened Middle East tensions. The sharp decline followed reports that Israel launched a bombing campaign in Iran, igniting widespread panic across risk assets.

ATOM found critical support near $4.04, suggesting a short-term floor in a highly volatile environment.

While ATOM faced steep losses, the decline was consistent with overall altcoin weakness. Traders moved out of riskier assets amid growing uncertainty, favoring defensive positions or shifting capital toward perceived safe havens like Bitcoin, which has surged 54% over the past 12 months, reaching a $2.08 trillion market cap.

Technical Breakdown: Support Holds After Heavy Volume Sell-Off

- ATOM dropped from $4.43 to $4.02, a 9.25% decline, during peak selling pressure between 19:00 and 00:00 UTC.

- Volume peaked at 2.8 million during the 02:00 hour as the price found support near $4.04.

- From 03:00 UTC, price stabilized around $4.08, forming a potential support zone between $4.04–$4.07, backed by strong volume.

- A break above $4.08 resistance at 13:31 UTC saw volume of 37,524, confirming bullish intent.

- Further momentum pushed price to $4.09, with volume spiking to 73,628 during the 14:00 candle.

This price structure signals a possible short-term bottom, with support now firm between $4.08 and $4.09.

Market Outlook: Eyes on Global Stability

ATOM’s recent movements highlight the sensitivity of altcoins to geopolitical developments. Despite strong fundamentals, assets like ATOM remain vulnerable to sudden macroeconomic shocks. The newly formed support zone near $4.08 offers a potential base for recovery, but market sentiment remains cautious.

Continued global instability could limit upside momentum, even as buyers begin stepping in at lower levels.

Conclusion: Short-Term Bottom Forming, But Risks Remain

While ATOM’s rebound from $4.02 has stabilized the chart, further confirmation is needed before bulls can confidently re-enter. Investors should monitor both volume trends and global headlines, as these will likely dictate near-term price direction.