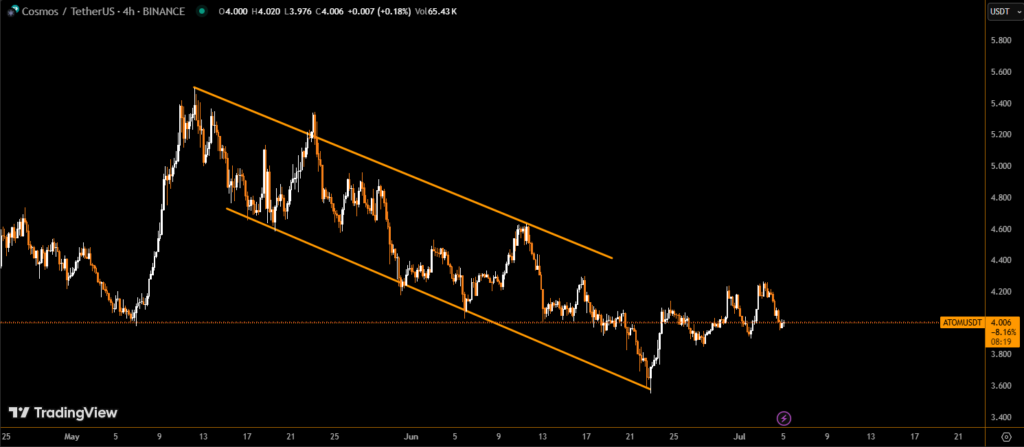

Cosmos’ ATOM token faced significant downward pressure over the past 24 hours, dropping nearly 4% as traders pushed the asset closer to a key psychological support level at $4.00. The decline reflects growing market uncertainty and aligns with a broader pullback in altcoins following Bitcoin’s recent price correction.

ATOM/USD Slips Below Key Support as Bearish Momentum Builds

Between July 3 at 15:00 and July 4 at 14:00, the ATOM/USD pair fell from $4.22 to $4.06, marking a 3.95% drop in just 24 hours. The selling intensified during the U.S. holiday session, with volume surging to 588,338 units—well above the daily average.

This spike in trading activity signals that sellers are actively defending resistance levels and appear to be gaining control as buyers step back.

Technical Breakdown: Failure to Hold $4.17 Sparks Decline

- Support at $4.17 was broken, triggering a steady decline through multiple intraday levels.

- A significant rejection at $4.09 led to intensified bearish pressure.

- The token attempted a brief recovery at 13:53, rebounding to $4.07, but couldn’t sustain the momentum, ultimately sliding back to $4.06.

- The most recent 60-minute window from 13:06 to 14:05 showed a further 0.61% drop, with 45,985 units traded at 13:50, confirming persistent selling interest.

The pattern of lower highs and lower lows on the intraday chart clearly indicates a continuation of the bearish trend, with the $4.00 mark acting as a crucial threshold.

Outlook: Can ATOM Hold the $4.00 Level?

The next few trading sessions are critical for ATOM. If the token fails to hold the $4.00 psychological support, further downside could accelerate, potentially testing multi-month lows. However, if bulls can defend this zone, a short-term relief bounce may occur, especially if market-wide sentiment stabilizes.

Investors and traders should watch for volume surges and price action near the $4.00 level, which will likely determine the next major move for Cosmos’ native asset.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.