Price Drops, Then Rebounds on Strong Demand

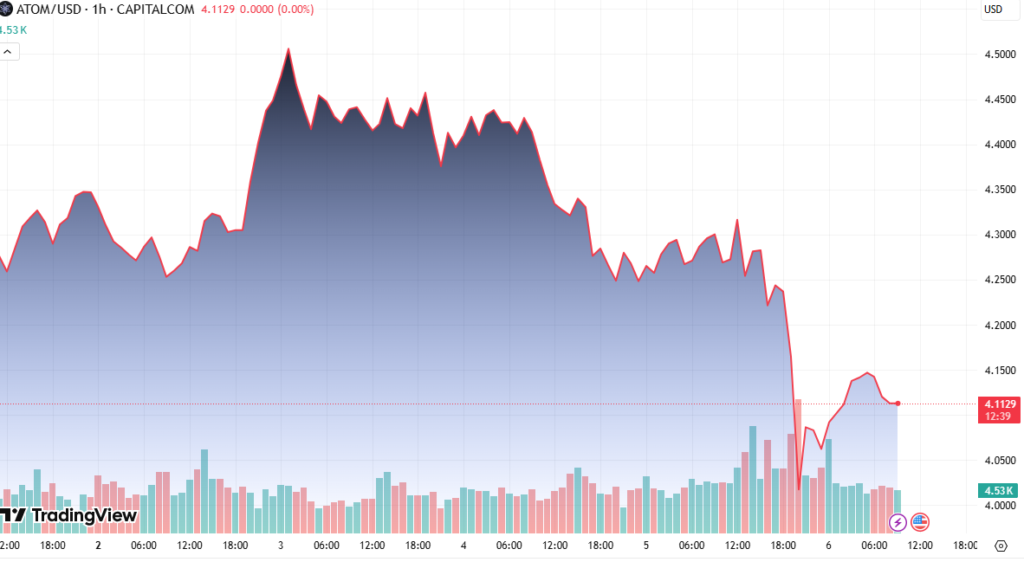

Cosmos (ATOM) faced downside pressure in recent trading, dropping 4.7% to a low of $4.25 before staging a modest recovery. The sell-off came amid broader market volatility, with geopolitical tensions and public clashes between key figures, such as Tesla CEO Elon Musk and U.S. President Donald Trump, influencing investor sentiment.

Despite the dip, ATOM found strong support at the $4.25 level, which triggered a recovery rally as buyers entered the market.

Institutional Interest at Key Support Zone

The technical structure of ATOM shows a well-defined support zone between $4.25–$4.27, validated by a volume spike of 1.42 million during the 20:00 hour. This signals potential institutional accumulation or whale buying activity, even as uncertainty grips crypto markets.

Such large-volume support suggests that ATOM’s current price floor is being defended aggressively, signaling a possible trend reversal.

Short-Term Technical Trends

As trading progressed, price action improved, with ATOM moving from $4.295 to $4.314, marking a 0.45% recovery. More importantly, the formation of higher highs and higher lows between 07:10 and 07:21 indicates a developing uptrend.

A key technical signal occurred at 07:15 and 07:20, when volume surged past 25,000 units, coinciding with a strong upward move toward $4.338.

The final 15 minutes of trading showed renewed bullish momentum, with ATOM establishing intraday support at $4.309 and closing close to its hourly high.

Market Context and Outlook

The ongoing geopolitical friction and monetary policy shifts are creating crosswinds for digital assets. While short-term volatility persists, the strong defense of support and volume-backed buying suggest confidence among larger market participants.

If ATOM sustains its move above $4.30 and breaks resistance near $4.34, a stronger recovery could unfold in the coming sessions.

Conclusion

ATOM’s ability to rebound after a sharp 5% drop highlights the importance of the $4.25 support level. Volume analysis points to accumulation by confident buyers, potentially setting the stage for a bullish reversal.

Investors should monitor volume and trend confirmation signals, as continued strength above $4.30 could lead to a test of higher resistance zones in the short term.