The Cosmos (ATOM) token displayed notable price volatility over the past 24 hours, facing rejection at a key resistance level but showing signs of strength with a 1.4% recovery on the hourly chart. Despite a failed breakout attempt, market sentiment remains cautiously optimistic as institutional interest and ecosystem upgrades lend support.

Price Action: Rejection Followed by Short-Term Bounce

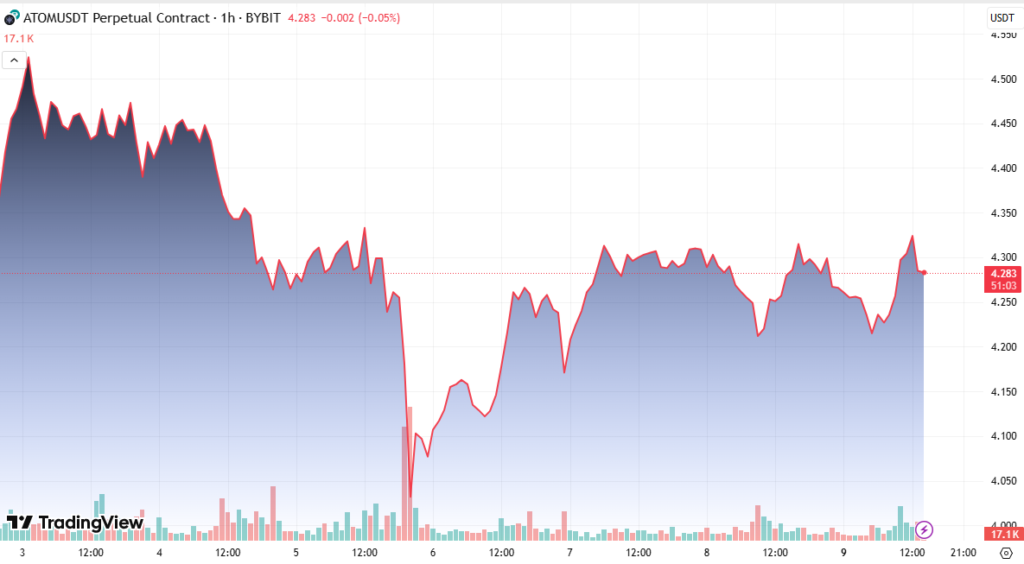

ATOM ranged 2.76% in 24 hours, peaking at $4.327 before retracing to trade around $4.29. The price attempted a breakout late on June 8 but was rejected at the resistance level, leading to a brief consolidation near $4.233.

Support emerged around $4.21, and following the rejection, heavy volume between 07:33 and 08:02 UTC helped lift the price to $4.239, marking a 1.4% bounce from the hourly low.

This movement suggests short-term traders are still active and ready to buy the dip when price stabilizes at known support zones.

Institutional Support Adds Momentum

Several institutional developments are offering a cushion to recent price weakness:

- Bitbank, a major Japanese crypto exchange, announced the listing of ATOM with promotional trading fees, boosting exposure to new users.

- Canary Capital is reportedly exploring a Cosmos-backed ETF, which could add long-term capital inflows if approved.

Such developments highlight growing confidence in Cosmos’ long-term potential from traditional and digital finance sectors alike.

Ecosystem Update: Cross-Chain Progress via Eureka

The Cosmos network, built as an interoperable layer for blockchain communication, recently deployed the Eureka upgrade. This update enhances cross-chain communication, particularly enabling seamless integration with Ethereum-based networks.

This expansion of interoperability is critical for Cosmos’ mission of becoming the internet of blockchains, offering increased utility for ATOM.

Technical Overview: Stabilization Possible

- Resistance: $4.327

- Support: $4.21 and newly formed $4.237

- Volume spike: 16,000+ units during hourly rebound

Conclusion

While ATOM failed to break through immediate resistance, the quick recovery and emerging support zones suggest buyers remain active. Combined with institutional momentum and ecosystem growth, Cosmos is showing resilience and may attempt another breakout if broader market conditions align.