Banks Face Profitability Challenges Under Strict Basel Standards

The Basel Committee on Banking Supervision (BCBS) has come under scrutiny from industry leaders for introducing capital reserve requirements that make it difficult for banks to engage in cryptocurrency activities. According to investment executives, these rules act as a hidden “chokepoint,” discouraging traditional financial institutions from allocating resources to the digital asset sector.

Chris Perkins, president of digital investment firm CoinFund, explained that the framework significantly reduces banks’ profitability when dealing with crypto. “The rules lower a bank’s return on equity by forcing higher reserve requirements for holding digital assets. It makes crypto-related activities too costly,” Perkins noted.

Capital Rules Suppress Crypto Growth

The BCBS regulations require banks to hold large capital buffers against volatile assets, classifying cryptocurrencies as high-risk. This, in effect, diverts capital away from digital finance and into traditional sectors. Perkins emphasized: “If I have a certain amount of capital to invest, I’ll choose high return businesses over low return ones. With crypto, the cost burden is too high.”

Industry analysts argue that this approach indirectly suppresses innovation by pushing banks out of blockchain adoption. While regulators frame the measures as risk control, executives see them as structural barriers limiting the sector’s growth.

BIS Push for Centralized Alternatives

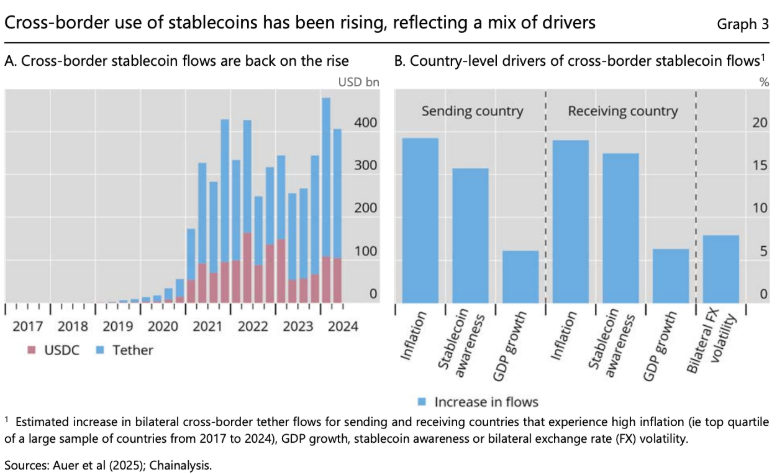

The Bank for International Settlements (BIS), which coordinates global banking policies, has reinforced its opposition to cryptocurrencies. Recent BIS reports warn that stablecoins and decentralized finance could destabilize financial systems, urging governments to prioritize central bank digital currencies (CBDCs) instead.

The report stated: “Stablecoins’ rising market capitalization and interconnections with the traditional financial system have reached a stage where potential spillovers can no longer be ruled out.”

With stricter rules in place, banks may remain hesitant to embrace digital assets, leaving growth largely in the hands of non-bank institutions and sovereign funds. The debate highlights a broader question: whether regulation is protecting the financial system or deliberately slowing the integration of crypto into mainstream banking.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.