Teng Points to Risk-Off Deleveraging as Crypto Follows Global Asset Trends

Bitcoin’s sharp retreat has raised alarm across markets, but Binance CEO Richard Teng is pushing back on the idea that crypto is behaving differently from traditional assets. Speaking at a media roundtable in Sydney, Teng argued that Bitcoin’s latest downturn reflects a broader risk-off environment affecting global asset classes, not an isolated crypto meltdown.

Bitcoin’s Decline Driven by Deleveraging, Not Structural Weakness

Teng said all markets go through cycles of stress, adding that this month’s sell-off is being amplified by investors unwinding leverage. “What you’re seeing is not only happening to crypto prices,” he told reporters. “There’s a bit of risk-off and deleveraging happening across markets.”

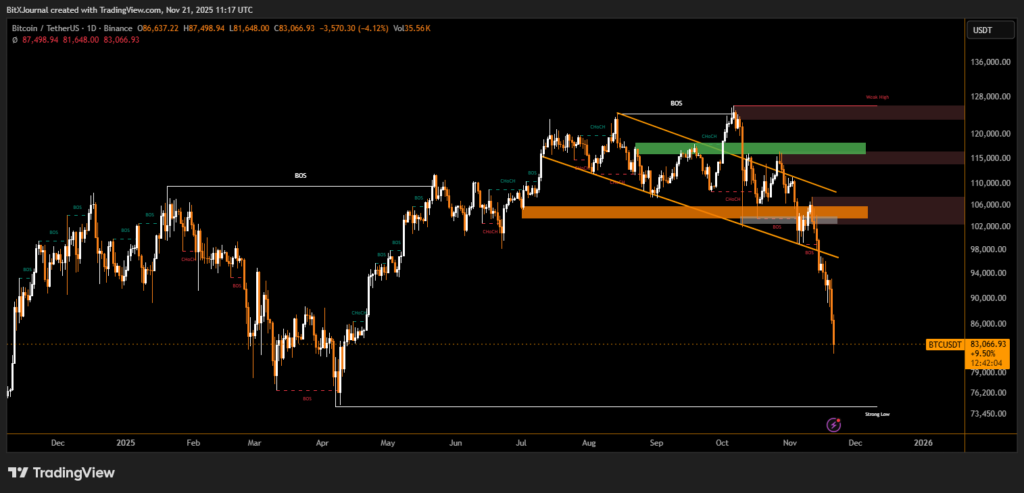

Bitcoin is currently trading just above $82,000, according to CoinMarketCap — down nearly 35% from its October record above $126,000. The broader crypto market has also retreated, with total capitalization falling to $2.84 trillion, a 33.6% decline from its peak.

Despite the slide, Teng said the market remains far healthier than commentary suggests. “Over the past 1.5 years, the crypto sector has performed very, very well, so it’s not unexpected that people take profit,” he noted. He added that periods of consolidation are healthy and help the industry “find its feet.”

Is Bitcoin Really as Volatile as Traditional Assets?

Teng’s claim that Bitcoin’s volatility is now comparable to major asset classes stands out, challenging a long-held assumption. BitBo data shows Bitcoin’s 60-day volatility in 2025 has ranged from just above 1% to peaks near 2.44%, reflecting comparatively stable conditions relative to earlier cycles.

Long-term data supports the trend. Research from September shows Bitcoin’s annualized volatility hit 181% in 2013, a level that fell to as low as 23% this year as adoption and liquidity expanded.

Comparisons with equities show the picture is nuanced. For a brief period during this year’s market turbulence, the S&P 500’s annualized volatility even surpassed Bitcoin’s, according to 21Shares. That spike, however, faded as traditional markets stabilized.

Current readings show Bitcoin’s annualized volatility above 50%, while the S&P 500 sits just over 15%. But Teng’s point is not without merit: several major tech stocks — including Tesla, AMD and Super Micro Computer — continue to post volatility readings above Bitcoin, highlighting that crypto is no longer alone at the high-volatility frontier.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.