BNB Consolidates Below Key Resistance as Bulls Aim to Reclaim Momentum

Binance Coin (BNB/USDT) is under renewed pressure after falling below the $1,080 short-term support, with price now trading around $1,017. The move marks a notable retracement from recent local highs, as the asset continues to consolidate beneath its multi-month resistance zones.

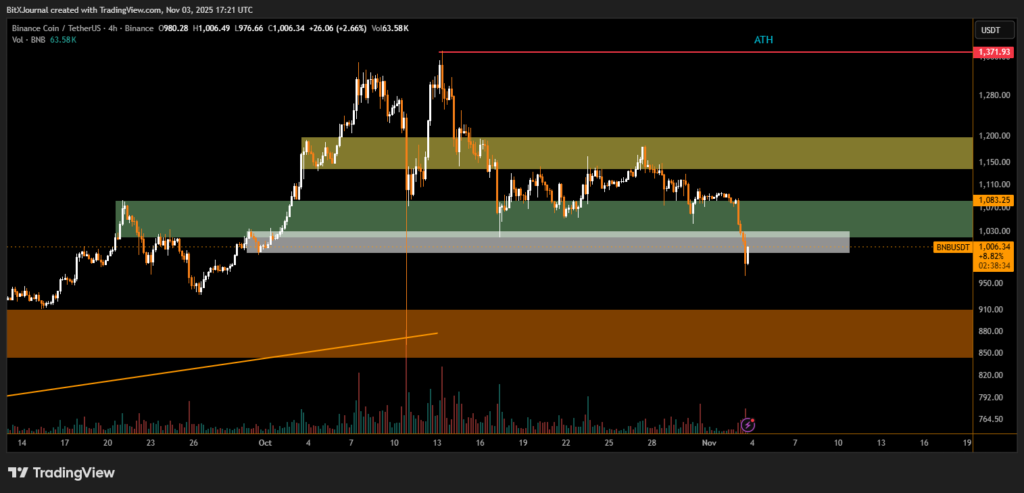

According to the latest 4-hour chart, BNB remains within a structured uptrend, though the recent pullback indicates fading momentum after an extended rally that saw the token surge more than 18% in October. The asset currently sits inside a critical grey support band between $1,000 and $1,040, an area that has repeatedly acted as a base for rebounds.

“The $1,000 mark is psychologically and technically important for BNB,” commented BitXJournal crypto market analyst. “If the coin holds above that zone, we could see a swift return toward $1,080 or even the upper resistance at $1,150.”

Above, traders are watching the yellow resistance range between $1,140 and $1,190, where previous rallies stalled before the asset began its current descent. Below that, the green support area near $1,060–$1,080 will likely define whether buyers can defend the trend.

A breakdown beneath $1,000 could expose BNB to a deeper correction toward $880, where the next major demand zone lies. Volume data also shows a modest uptick in selling activity, with 114,000 BNB traded in recent sessions, reflecting heightened market interest during the decline.

Despite short-term weakness, BNB’s broader structure remains constructive. The asset has continued forming higher lows since early September, suggesting that underlying bullish sentiment persists as long as price remains above $900.

BNB’s ability to hold its $1,000 support zone will likely determine the next leg of market direction — a decisive rebound could reestablish strength toward its all-time high near $1,371.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.