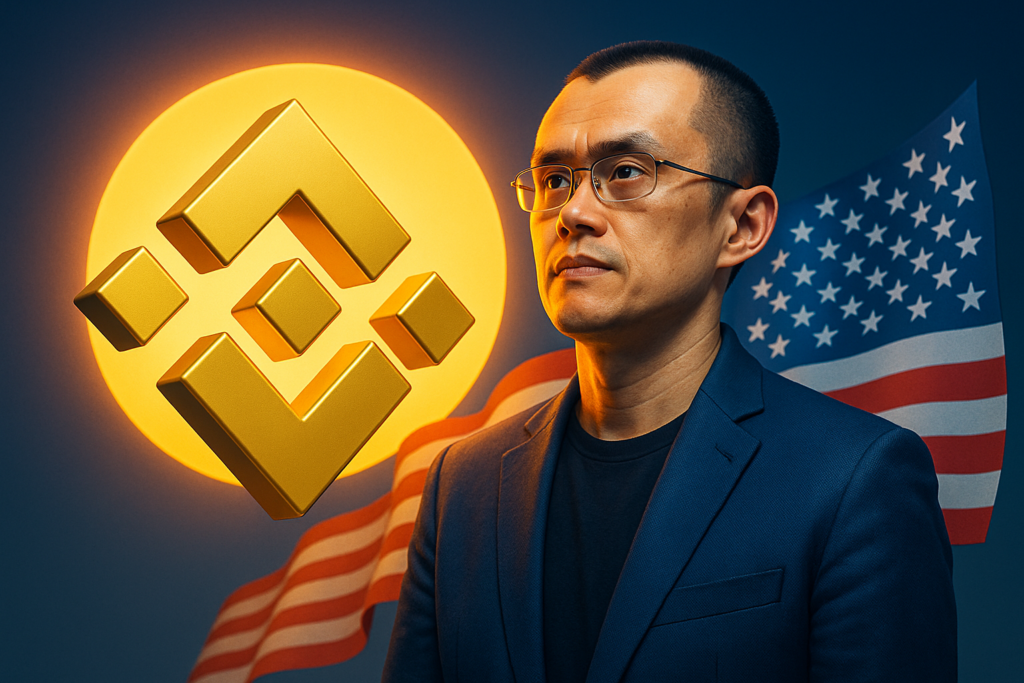

Industry leaders see new opening for Binance in the US after Donald Trump pardons founder Changpeng Zhao

Changpeng “CZ” Zhao, the founder of Binance, has been officially pardoned by US President Donald Trump, reigniting widespread speculation that the world’s largest crypto exchange could stage a return to the United States.

Following the pardon, CZ posted on X (formerly Twitter): “Will do everything we can to help make America the capital of crypto and advance Web3 worldwide.” His account bio also changed from “ex-Binance” back to simply “Binance,” a move seen by analysts as symbolic of a potential comeback.

According to Bloomberg, insiders and traders interpreted the change as a signal that Binance may re-engage with the US market, where it previously scaled back operations due to regulatory pressure.

Industry Voices Welcome the Move

“CZ’s pardon is more than an inflection point — it’s also a pivotal moment for BNB and potentially for Binance itself,” said David Namdar, CEO of BNB Network Company, in a post on X. He added that BNB has been overlooked by Western investors, despite its strong price performance through recent cycles.

BNB’s price has rallied to all-time highs in October, showing renewed investor confidence amid speculation surrounding Binance’s regulatory reentry.

A successful comeback would reopen access for US retail traders to the exchange’s deep liquidity pools, potentially boosting overall crypto trading volumes and market momentum.

Political Divide Over the Pardon

Trump told reporters that CZ’s pardon came after “a lot of people” in the crypto industry voiced support. “He served four months in jail, and they say he wasn’t guilty of anything,” Trump said during a White House briefing.

However, Democratic lawmakers, including Representative Maxine Waters and Senator Elizabeth Warren, sharply criticized the decision. Waters called it a case of “pay-to-play politics,” accusing Trump of being swayed by crypto donors.

Zhao fired back on social media, saying Warren falsely claimed he pleaded guilty to money laundering. In reality, he admitted only to violating the US Bank Secrecy Act by failing to implement effective AML controls at Binance — a charge that led to a four-month prison sentence in April 2024.

While Binance.US continues to operate under BAM Trading Services, it lacks access to the global exchange’s liquidity and derivatives markets. If regulatory conditions improve, analysts believe a formal re-entry could mark a turning point for US crypto adoption under a more favorable administration.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.