New system could flag and freeze tainted Bitcoin and stablecoins before cash-out

BASEL, SWITZERLAND – The Bank for International Settlements (BIS) has unveiled a proposal to make cashing out illicit cryptocurrency significantly harder, suggesting a provenance-based compliance score for all crypto holdings before they are exchanged for fiat currency.

Outlined in the BIS Bulletin released Wednesday, the system would assign an Anti-Money Laundering (AML) score to each crypto unit or wallet based on its transaction history and potential links to criminal activity. Off-ramps converting crypto to fiat would then use this score to determine whether to approve, deny, or flag transactions.

“Imposing a duty of care on these entities would incentivize them to avoid accepting or paying out tainted coins, as failure to comply could result in fines or other penalties,” the BIS wrote.

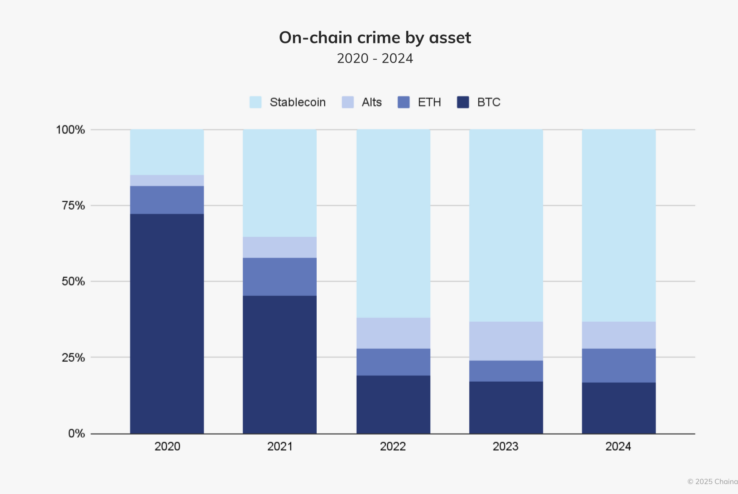

According to BIS, stablecoins have overtaken Bitcoin as the primary choice for illicit crypto flows since 2022. Reports from Chainalysis and TRM Labs indicate that in 2024, stablecoins accounted for 63% of all detected illicit crypto transactions.

The proposed AML scoring framework would monitor Bitcoin UTXOs and stablecoin wallets, embedding a risk score directly into the asset. BIS suggests that “tainted” stablecoins could eventually trade at a discount due to their limited usability in regulated exchanges.

Targeting the off-ramps — and possibly individuals

The plan focuses heavily on crypto-to-fiat off-ramps, but BIS acknowledges that the duty of care could extend to individual holders. If affordable compliance tools become widespread, the BIS says, claims of unknowingly holding tainted crypto will be harder to defend.

Under the proposal, risk scores could “travel” with the token as it moves through blockchain transactions, influencing how it is treated across exchanges and even in decentralized trades.

The BIS argues that while traditional AML measures have limited reach in the crypto ecosystem, blockchain’s transparent transaction history offers regulators an unprecedented tool for financial crime prevention — potentially reshaping how crypto interacts with the banking system.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.