Bit Digital (BTBT) shares fell nearly 4% on Wednesday after the company announced a major shift away from Bitcoin mining to fully embrace Ethereum staking and treasury accumulation. This strategic pivot marks a bold new direction for the publicly listed crypto firm, raising eyebrows among investors.

From Bitcoin Mining to Ethereum Staking

In a press release, Bit Digital said it would wind down or sell off its existing Bitcoin (BTC) mining operations and use the proceeds to buy more Ether (ETH). Additionally, the company plans to gradually convert its entire BTC holdings into ETH, though no firm timeline has been provided.

“Bit Digital aims to become a pure-play Ethereum staking and treasury company,” the statement noted, underscoring a long-term commitment to the Ethereum ecosystem.

Bit Digital first began building its Ethereum staking infrastructure in 2022, and now looks to expand its ETH holdings significantly.

ETH Treasury Set to Surpass 42,000 Coins

As of March 31, the firm held 24,434 ETH and 417.6 BTC. If all BTC were converted at current rates, Bit Digital’s treasury would increase by approximately 18,000 ETH — pushing total reserves above 42,000 ETH.

This would make Bit Digital one of the largest corporate holders of Ether worldwide, currently ranking third among publicly traded companies behind SharpLink Gaming and Coinbase.

Stock Slumps After Announcement

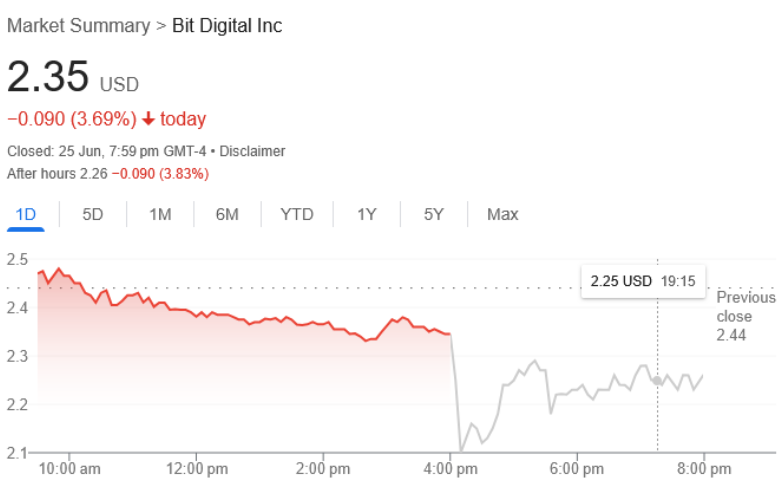

Bit Digital’s pivot wasn’t well received on Wall Street. Shares fell 3.69% to $2.35 during Wednesday’s trading session, and dropped another 3.83% after hours, closing at $2.26, according to Google Finance.

The stock is down 25% year-to-date and has fallen 39% from its January peak of $3.88.

The company also announced plans to sell its own stock to raise capital for more ETH purchases, which may have contributed to investor unease.

Industry Trend: More Firms Turning to ETH

Bit Digital isn’t alone in the shift toward Ethereum. SharpLink Gaming recently purchased $463 million in ETH, followed by an additional $30 million this week. The trend reflects growing confidence in Ethereum’s long-term value and staking economics, especially amid Bitcoin’s energy and regulatory pressures.

Ethereum’s staking model is increasingly seen as more sustainable and scalable than Bitcoin mining.

Final Thoughts

Bit Digital’s pivot could signal a larger strategic trend as crypto firms reposition for the next phase of blockchain adoption. While short-term investors reacted negatively, the move may pay off as Ethereum staking yields and adoption grow in the coming years.

The firm is betting big on ETH — now the question is whether the market will reward that conviction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.