Bitcoin fell below $73,000 this week, marking fresh yearly lows as volatility increased across global markets. The decline comes amid signs of mounting economic strain in the United States, where high government debt levels and elevated borrowing costs continue to tighten financial conditions. Market data suggests that the next meaningful accumulation phase for Bitcoin may be closely tied to shifts in credit market stress rather than immediate price movements.

Credit Spreads Remain Tight Despite Rising Risk

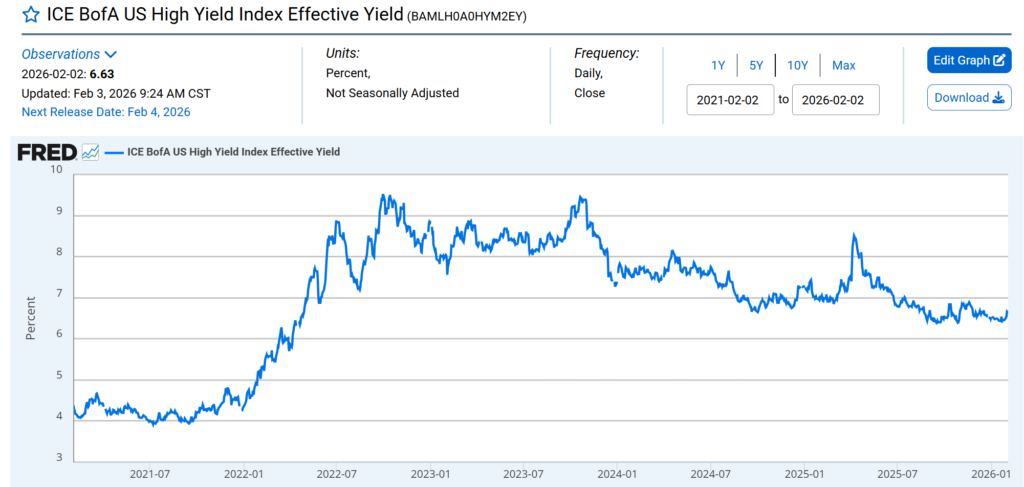

One key indicator drawing attention is the ICE BofA US Corporate Option-Adjusted Spread, which measures the additional yield investors demand for holding corporate bonds over US Treasurys. The spread is currently around 0.75, its lowest level since the late 1990s, signaling that credit risk may be underpriced.

This compression contrasts sharply with broader conditions. US government debt has climbed to approximately $38.5 trillion, while the 10-year Treasury yield has risen to about 4.28%, reinforcing restrictive financial conditions. In previous Bitcoin market cycles, local price bottoms formed only after credit spreads began to widen, typically with a delay of three to six months.

Onchain Data Shows Mixed Signals

Onchain data indicates an uptick in short-term selling, with large Bitcoin holders transferring significant amounts to exchanges. However, longer-term pressure appears to be easing. The spent output profit ratio has fallen toward 1, suggesting seller exhaustion is developing.

If credit spreads begin to widen in the coming months, historical patterns point to a potential accumulation window emerging later in 2026, as markets adjust to deeper credit stress.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.