Digital assets retreat amid risk-off sentiment and technical weakness

Crypto markets lost momentum on Thursday as Bitcoin dropped below $108,000 and Ethereum slipped under $3,750, signaling renewed selling pressure after a month of subdued optimism. The pullback has cast doubt on expectations for a strong “Uptober,” a historically bullish period for digital assets.

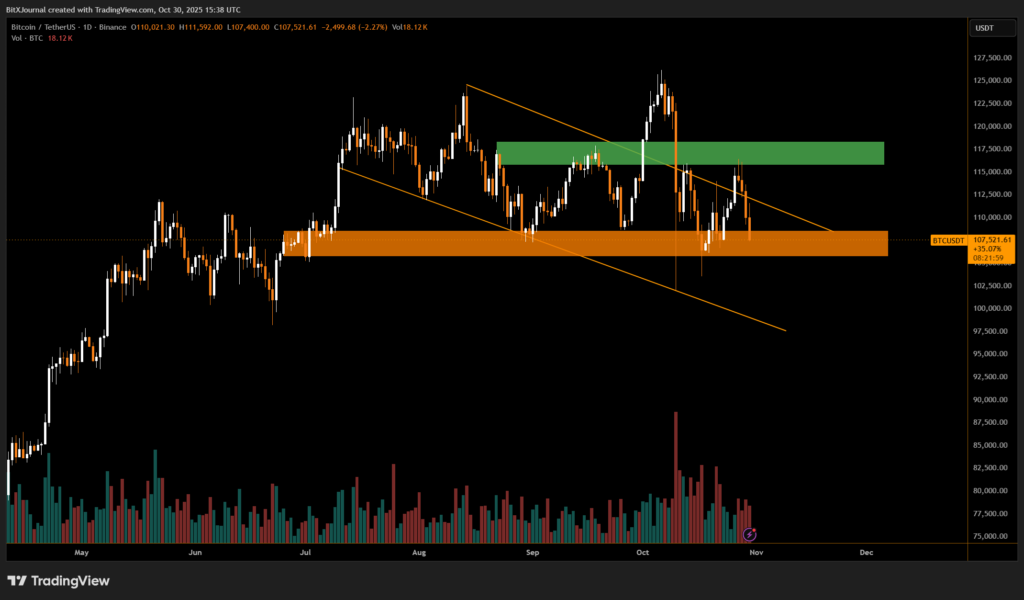

After briefly touching $111,500 earlier this week, Bitcoin failed to hold above a key resistance zone near $115,000–$117,000, as shown on the charts. The coin has now fallen back toward a critical support area between $106,000 and $107,000, marked by a descending channel. A sustained break below this range could open the way toward $100,000, analysts said.

“Bitcoin’s technical structure has weakened, with lower highs forming since mid-September,” noted BitXJournal market strategist at a digital asset research . “If buyers fail to defend the $107,000 zone, we could see deeper retracement before any new upside attempt.”

Meanwhile, Ethereum also saw its trendline tested, with the price dipping below the ascending support near $3,800. The next major demand area lies around $3,600–$3,500, aligning with previous accumulation zones from July. “ETH’s structure remains constructive in the long term, but short-term momentum has clearly faded,” another analyst said, adding that macro uncertainty and declining liquidity are amplifying volatility across risk assets.

The broader crypto stock sector also declined, mirroring weakness in major tokens. Market observers attributed the drop to renewed caution following mixed corporate earnings and slower inflows into spot crypto ETFs.

Despite the recent weakness, traders remain watchful for potential rebounds from key support zones. Historically, October often closes with positive returns, but this year’s pattern appears to be breaking tradition.

“Market sentiment has shifted from optimism to caution,” BitXJournal analysts said. “A clear breakout above $115K for Bitcoin or $4K for Ethereum would be needed to revive bullish momentum.”

For now, the charts suggest consolidation may continue as investors await fresh catalysts heading into November’s macro data releases.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.