Crypto markets stabilize as BTC holds above $106,000 and ETH trades steady over $3,600, signaling renewed investor confidence.

Bitcoin and Ethereum Price Update

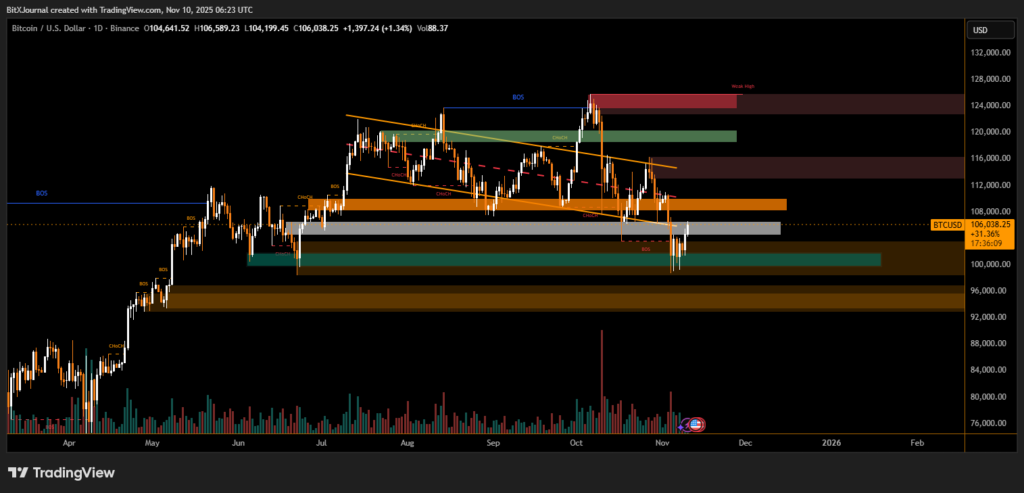

Bitcoin (BTC) maintained its bullish stance this week, trading above $106,000, as market momentum stabilized following recent volatility. Ethereum (ETH) also showed resilience, hovering near $3,605, with technical charts indicating strong buyer presence around the $3,500–$3,600 support zone. The broader digital asset market displayed a cautious yet positive tone as traders positioned for potential breakouts ahead of mid-November data releases.

According to trading volume metrics, BTC’s daily volume surged 31% compared to the previous week, suggesting renewed inflows from institutional investors. “The market seems to be stabilizing after short-term corrections, with liquidity now building near higher support regions,” said BitXJournal market analyst.

Technical Analysis: BTC Testing Key Zones

On the daily chart, Bitcoin is consolidating between $104,000 and $108,000, forming a mild ascending structure after reclaiming the $100,000 psychological level. The breakout from the descending channel seen earlier this month has encouraged bullish traders to re-enter positions.

Analysts emphasize that “as long as BTC holds above $102,000, the bias remains bullish toward the $110,000–$112,000 range.”

However, resistance remains strong near $124,000, where previous highs align with a key supply zone. Any rejection from that area could invite a short-term retracement toward $98,000.

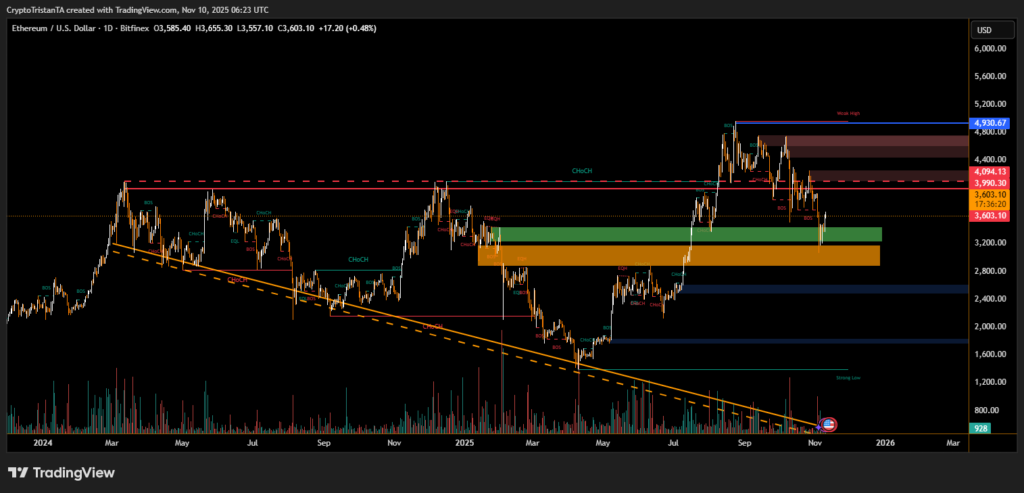

Ethereum Finds Support Above $3,600

Ethereum continues to mirror Bitcoin’s trend, showing signs of accumulation above $3,600. The price action remains inside a broader range between $3,200 and $4,000, with technical indicators suggesting potential continuation toward $3,990 if momentum sustains.

BitXJournal Market experts note that “ETH’s structure remains constructive, provided it holds above $3,500,” hinting at the possibility of retesting $4,000–$4,200 levels in the coming weeks. Increased DeFi activity and consistent staking demand are helping stabilize Ethereum’s mid-term outlook.

As macro conditions remain uncertain, crypto investors are closely watching both assets for directional cues. Bitcoin’s dominance continues to influence overall sentiment, while Ethereum’s steady fundamentals add to long-term confidence.

For now, both BTC and ETH remain technically strong, underlining that the recent correction phase might have been a healthy reset before the next potential leg higher.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.