Institutional Investors Return After Massive Weekend Liquidations

After a turbulent weekend that saw one of the largest crypto market liquidations in history, Bitcoin and Ethereum spot ETFs are showing signs of recovery. On Tuesday, the funds recorded a combined $340 million in net inflows, reversing the previous day’s $755 million in outflows, according to data compiled by SoSoValue.

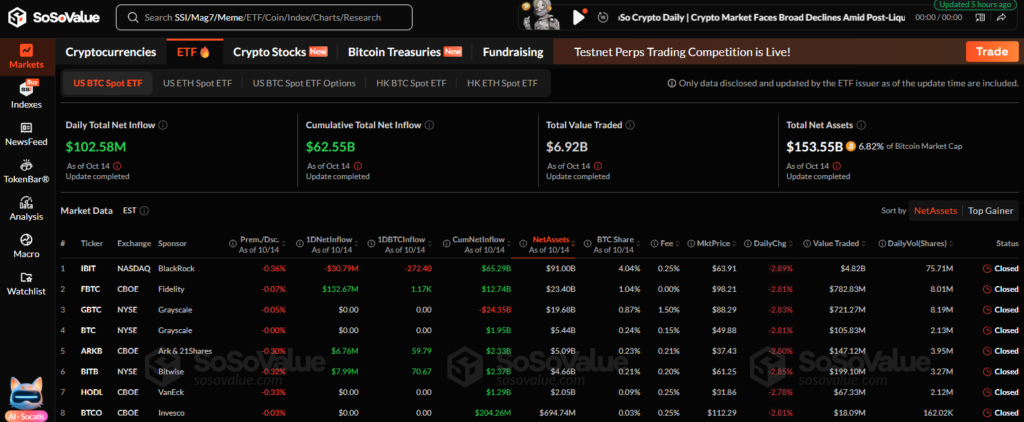

Spot Bitcoin ETFs attracted $102.6 million in total daily inflows, led by Fidelity’s FBTC, which added $132.67 million. ETFs from Ark & 21Shares and Bitwise also posted positive movements, though BlackRock’s IBIT and Valkyrie’s BRRR saw outflows of $30.8 million and $14 million, respectively.

Meanwhile, Ethereum spot ETFs logged an even stronger recovery, pulling in $236.22 million across six funds. Fidelity’s FETH again led the charge with $154.62 million in inflows, while Grayscale, VanEck, Franklin Templeton, and Bitwise also reported renewed investor interest.

Market analysts said the rebound suggests institutional buyers are cautiously re-entering after a weekend wipeout that erased more than $500 billion in total crypto market capitalization. The downturn followed confirmation from U.S. President Donald Trump that he intends to impose a 100% tariff on Chinese imports, sparking fears of a broader trade war.

“The $755 million outflow earlier this week reflected short-term panic rather than a structural shift,” noted Vincent Liu, Chief Investment Officer at Kronos Research. He added that ETF inflows show confidence is stabilizing, even as macroeconomic risks remain elevated.

Bitcoin (BTC) rose 0.58% in the past 24 hours to trade near $112,423, while Ether (ETH) climbed 2.84% to $4,112, according to aggregated market data.

“We should expect volatile swings as traders react to U.S.-China trade headlines and the upcoming Nov. 1 tariff deadline,” said Augustine Fan, Head of Insights at SignalPlus, cautioning that markets remain “choppy” following last Friday’s multi-sigma selloff.

The latest ETF inflows suggest that while the market remains fragile, institutional conviction in digital assets is far from broken.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.