Crypto markets rebound sharply amid dovish tone from Fed Chair

Bitcoin (BTC) and Ethereum (ETH) surged in early trading hours on Monday after U.S. Federal Reserve Chair Jerome Powell signaled a potential pause in rate hikes, fueling a wave of optimism across digital assets. The market’s response was immediate, with Bitcoin reclaiming the $113,000 mark and Ethereum rising back above $4,150, reversing much of last week’s losses.

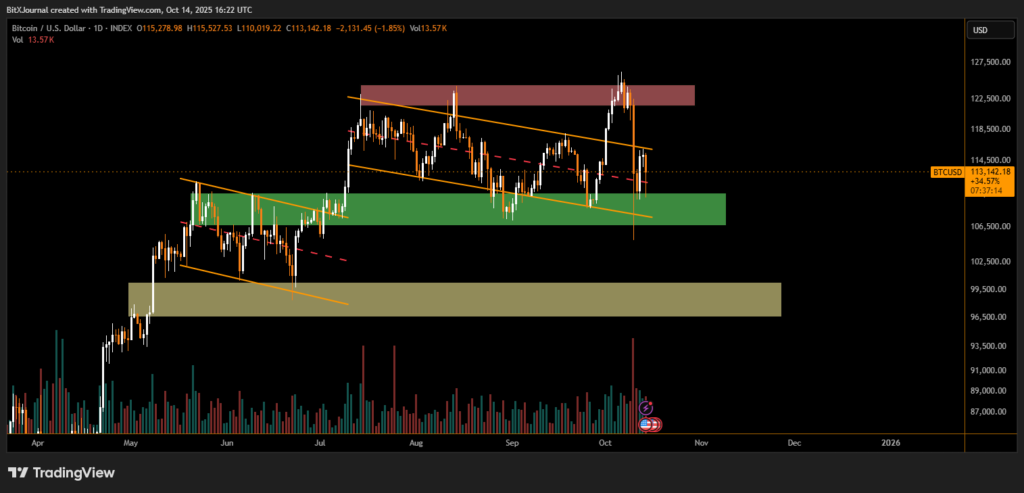

Bitcoin’s rebound followed a clear break from its mid-channel support, highlighted around the $107,000–$108,000 region. The chart shows a descending parallel channel, with the lower band now acting as a springboard for bullish momentum. Trading volume also spiked, suggesting renewed institutional accumulation.

“The short-term structure remains constructive,” said BITX market analyst. “If Bitcoin sustains above $112,000, the next key resistance sits around $118,000–$120,000, where profit-taking could emerge.”

The broader sentiment flipped positive as the green demand zone held firm. Traders are closely watching for a daily close above $114,000 to confirm bullish continuation.

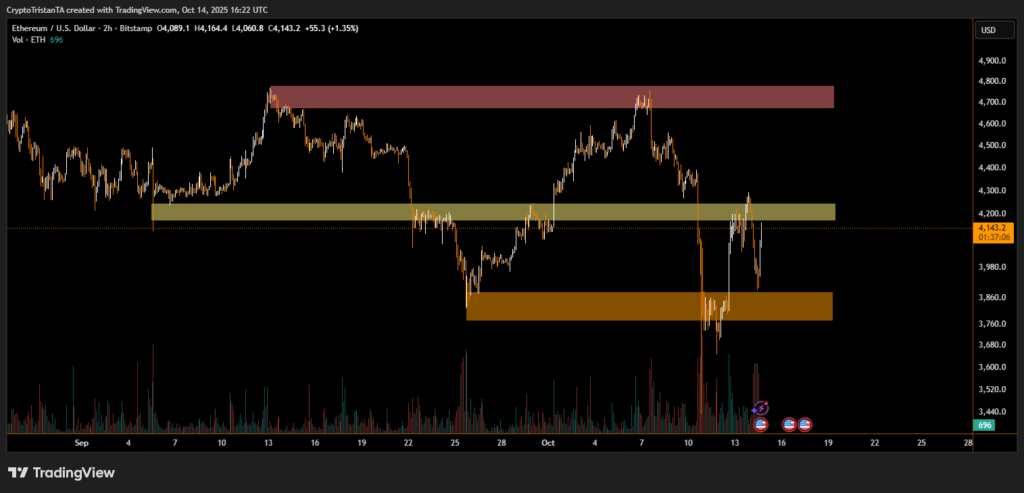

Ethereum mirrored Bitcoin’s strength, reclaiming key support near $3,850 and quickly pushing toward the $4,200 zone. The rebound aligns with a shift in risk appetite following Powell’s remarks. The chart reveals a strong bounce from a two-week demand block, with a potential retest of $4,450–$4,700 if volume sustains.

According to BITX , “The ETH chart reflects resilience. The market absorbed the macro shock efficiently, and the bullish engulfing pattern signals that buyers are back in control.”

Powell’s measured tone on inflation and interest rates revived optimism across risk assets, with equities and crypto both responding positively. Analysts underline that sustained recovery depends on upcoming economic data, but for now, the path of least resistance appears upward.

Bitcoin and Ethereum’s synchronized surge underscores renewed investor confidence, as both assets reclaim critical technical levels and signal potential continuation — provided the macro narrative remains supportive.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.