Market Volatility Retreats as Bullish Momentum Builds

Fresh volatility readings across major financial markets suggest that a potential year-end bull rally may be forming. Recent movements in implied volatility for both Bitcoin and the S&P 500 indicate strengthening market confidence, supported by rising expectations of a December Federal Reserve rate cut.

Bitcoin and S&P 500 Volatility Trends

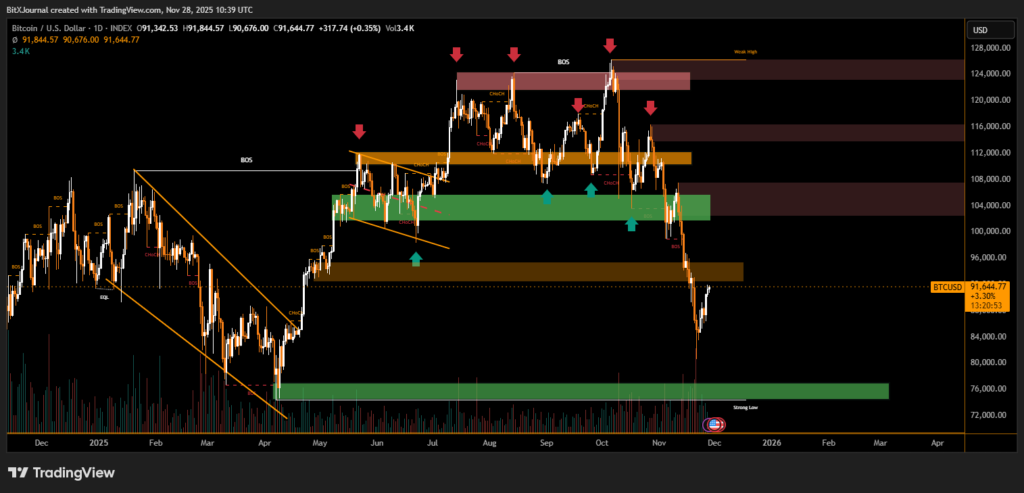

Implied volatility indices connected to Bitcoin and the S&P 500 have rapidly cooled, erasing the sharp spikes seen earlier in November. Bitcoin’s 30-day implied volatility index, BVIV, has fallen back to 51%, retreating from an intense surge to nearly 65% just days earlier. This spike occurred as Bitcoin slid from around $96,000 to near $80,000, but the quick reversal signals stabilizing sentiment.

Other metrics, including Deribit’s DVOL, show the same spike-and-drop pattern, mirroring volatility shifts in traditional markets.

Meanwhile, the VIX index, which monitors 30-day implied volatility in the S&P 500, climbed to 28% in the week before Nov. 21 but has since eased to about 17%. Such rapid cooling typically reflects reduced panic and renewed risk appetite.

Bitcoin Price Recovery Strengthens Bullish Outlook

Bitcoin has rebounded strongly, regaining levels above $91,000, continuing its notable inverse correlation with volatility. This shift underscores the asset’s growing alignment with broader market behavior, strengthening the case for a synchronized equity-crypto rally.

Market analysts highlight that lower volatility often marks the return of bullish control, suggesting that upward momentum may dominate as the final month of the year approaches.

Rate Cut Expectations Drive Sentiment

A key driver behind the volatility decline is the surging probability of a December Fed rate cut, which has jumped from 39% to nearly 87% within a week. This shift reduces demand for downside protection, leading traders to unwind excessive put-option hedges.

Option market data shows that one-week and one-month call-put skews have moved from -7% to -10% last week to around -5%, indicating reduced fear and a softer bias toward protective positioning.

Industry analysts note that markets are stabilizing as expectations solidify around easier monetary policy. This combination of cooling volatility, recovering prices, and rising liquidity expectations supports the argument that a year-end rally in both Bitcoin and U.S. equities may already be forming.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.